EURUSD fades the initial optimism and flirts with 1.0350

- EURUSD comes under pressure after faltering around 1.0400.

- The greenback recovers ground lost amidst higher yields.

- EMU final CPI figures showed the CPI rose 10.6% YoY in October.

Sellers now regain the upper hand and drag EURUSD well back below the 1.0400 region on Thursday.

EURUSD looks to US data, risk trends

EURUSD now trades on the defensive following two consecutive daily pullbacks on the back of some recovery in the greenback. On the latter, the USD Index looks to put further distance from recent lows in the 105.30 region (November 15) and climbs past the 106.50 region so far.

The corrective move in the pair is so far accompanied by another downtick – the fourth in a row – in the German 10-year bund yields.

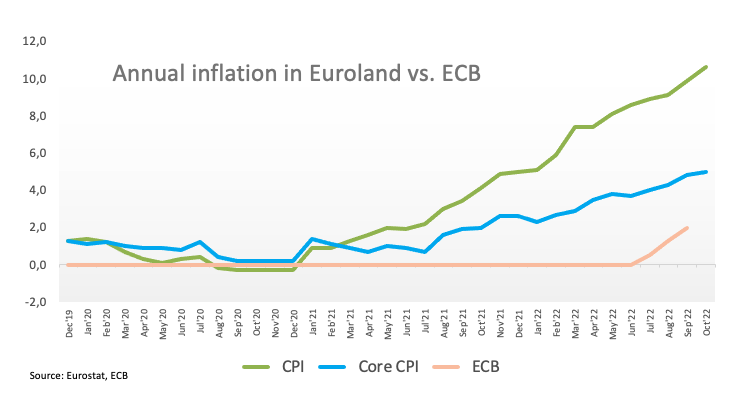

In the domestic calendar, final inflation figures in the euro area saw the CPI rise 10.6% in the year to October and 5% when it comes to the Core CPI.

Across the ocean, weekly Initial Claims come first along with the Philly Fed Manufacturing Index, Building Permits and Housing Starts. Additionally, FOMC’s M.Bowman (permanent voter, centrist) and P.Jefferson (permanent voter, centrist) are also due to speak.

What to look for around EUR

EURUSD remains unable to print a daily close above the key 1.0400 mark so far, sparking some selling pressure as a consequence.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy has become the exclusive source of the sharp advance in the pair in recent sessions.

Back to the euro area, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – emerges as the main headwinds facing the euro in the short-term horizon.

Key events in the euro area this week: Final EMU Inflation Rate (Thursday) - ECB C.Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is retreating 0.28% at 1.0364 and a breach of 1.0024 (100-day SMA) would target 0.9925 (low November 10) en route to 0.9730 (monthly low November 3). On the other hand, the next up barrier comes at 1.0481 (monthly high November 15) seconded by 1.0500 (round level) and finally 1.0614 (weekly high June 27).