When is Canadian CPI and how could affect USD/CAD?

Statistics Canada will release its inflation figures tracked by the CPI for the month of January at 1330h GMT, along with Bank of Canada’s gauge of Core CPI.

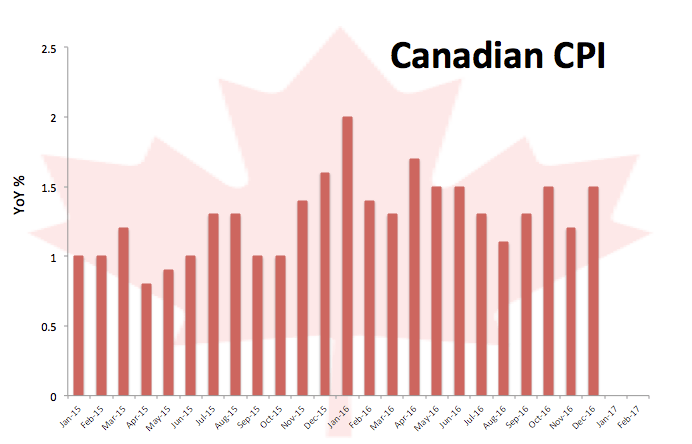

Market consensus expects consumer prices to have ticked higher at an annualized 1.6% during last month and 0.3% on a monthly basis, both prints reflecting a continuation of the recent up trend.

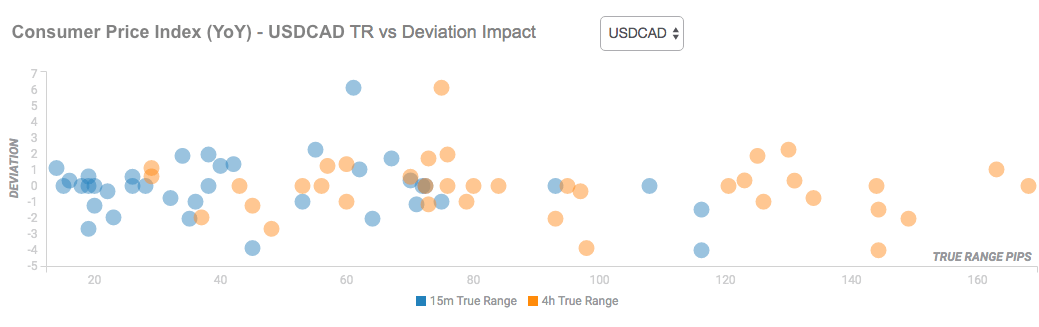

Impact on FX

USD/CAD seems to have found some support in the 1.3080 area so far today amidst a continuation of the offered bias around the greenback, particularly since yesterday’s comments by US Treasury Secretary S.Mnuchin. Anyway, spot continues to navigate familiar ranges mainly on the back of US-CA yields spread differentials. A positive surprise today should see the pair testing the lower bound of the recent range around 1.3050, while a potential test of the 200-day sma should not be ruled out if data disappoint.

About Canadian CPI

The Consumer Price Index (CPI) released by the Statistics Canada is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of CAD is dragged down by inflation. The Bank of Canada aims at an inflation range (1%-3%). Generally speaking, a high reading is seen as anticipatory of a rate hike and is positive (or bullish) for the CAD.