GBP/JPY bulls defending the 149.00 handle post dovish BoJ

- The GBP/JPY is only slightly affected by worse-than-expected UK data.

- The Bank of Japan maintains its dovish stance.

The GBP/JPY is trading at around 149.04 up 0.16% after challenging the highs of Monday and flirting with the 149.80 level with the bulls defending149.00 on Tuesday despite worse-than-expected macro data coming from the UK. The Consumer Price Index and retail sales index, both came below expectation but the Guppy traders didn’t seem too worried as they kept buying any incursion below the 149.00 level with the price unable to fall below 148.80 on Thursday so far.

Supporting the pair are also the dovish comments made by the newly appointed Deputy Governors of the Bank of Japan who confirmed that the BoJ will continue its aggressive monetary easing until the 2% inflation target is reached.

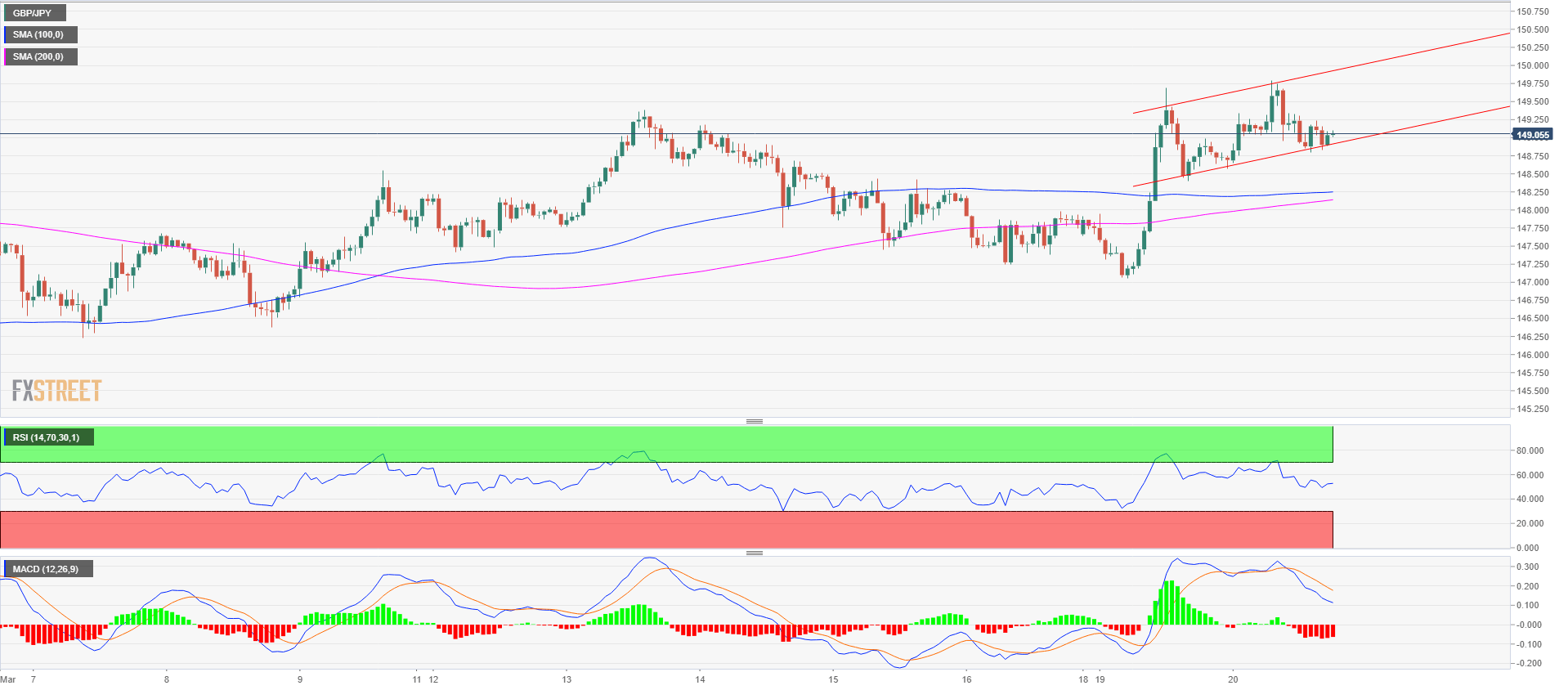

GBP/JPY 1-hour chart

Bulls are creating a bull channel after the huge breakout we saw on Monday.

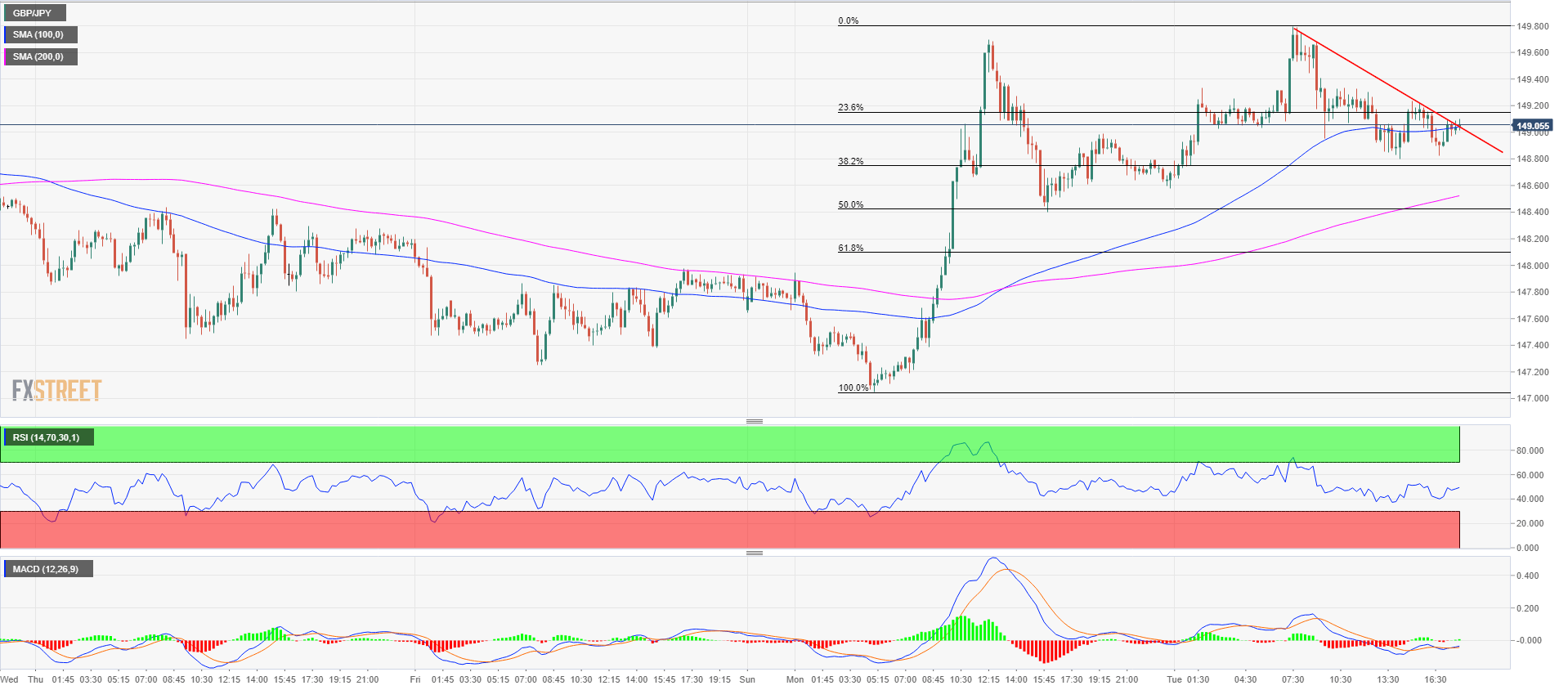

GBP/JPY 15-minute chart

Bulls are currently trying to break above an intraday descending trendline. Intraday resistance is seen at 149.60 previous supply/demand zone and the 151.00 figure. To the flip side, and if bears take the upper hand and are able to break below 148.80, then support is seen at the 148.40 level which is the 50% Fibonacci retracement from Monday’s bull run, followed by 148.10, the 61.8 Fibonacci retracement of the same rally.