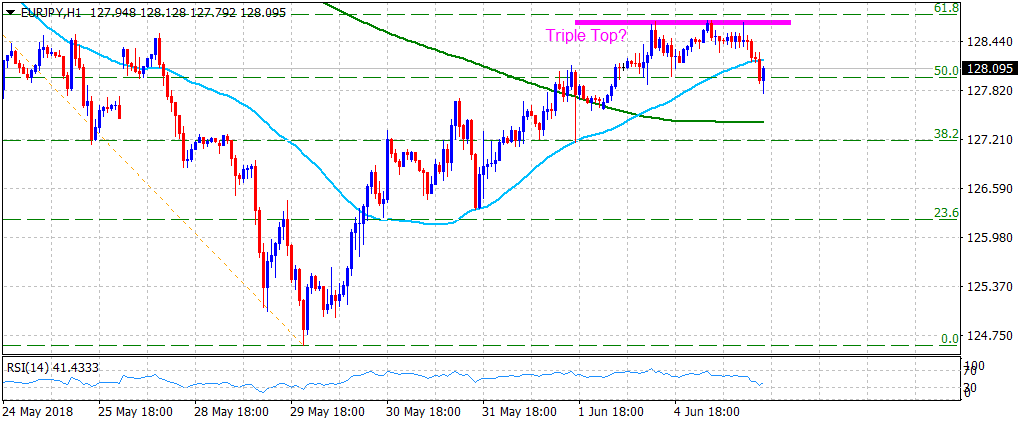

EUR/JPY Technical Analysis: breaks below 50-hour SMA, now seems vulnerable

• The cross snapped three consecutive days of winning streak and stalls the ongoing recovery move from 11-month lows set last week.

• Forms a triple top bearish chart pattern on the 1-hourly chart and retracement back below 50-hour SMA prompted some fresh technical selling in the past hour, which could get extended towards 200-hour SMA support.

• Now a sustained move beyond the 128.70 region, nearing 61.8% Fibonacci retracement level of the 131.04-124.62 recent fall, is needed to negate the bearish pattern formation.

EUR/JPY 1-hourly chart

Spot Rate: 128.10

Daily High: 128.70

Daily Low: 127.79

Trend: Bearish

Resistance

R1: 128.27 (daily pivot)

R2: 128.70 (daily swing high)

R3: 128.86 (100-period SMA H4)

Support

S1: 127.64 (100-period SMA H1)

S2: 127.17 (S2 daily pivot-point)

S3: 126.94 (161.8% Fibonacci retracement level)