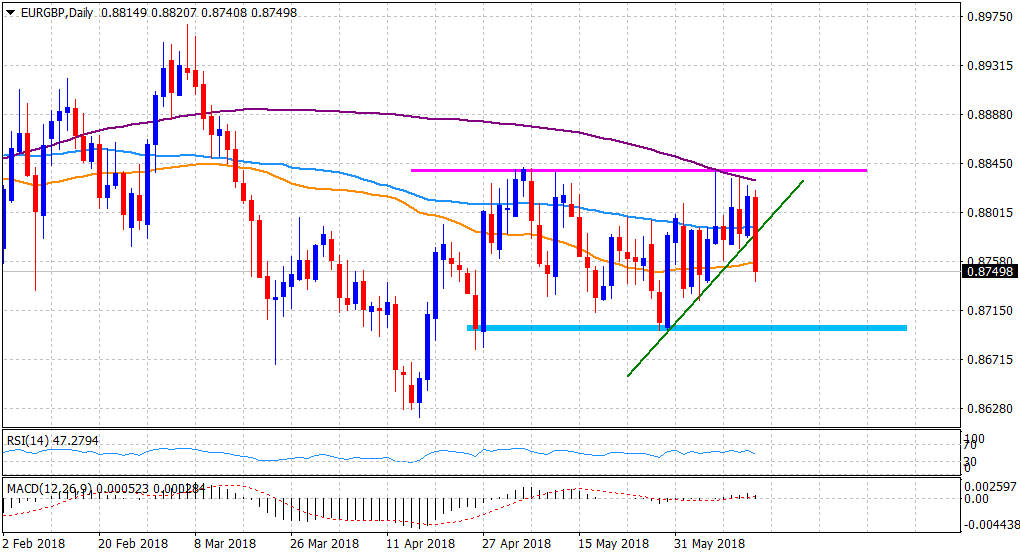

EUR/GBP Technical Analysis: headed back towards retesting 0.8700 handle

• Extends this week's rejection slide from the very important 200-day SMA, with upbeat UK retail sales data triggering the initial leg of downside on Thursday.

• The selling pressure aggravates post-dovish ECB twist, dragging the cross below 100-day SMA, an ascending trend-line and 50-day SMA supports.

• The downfall could now get extended towards the 0.8700 horizontal support, which if broken would set the stage of additional near-term downfall.

EUR/GBP daily chart

Spot Rate: 0.8750

Daily High: 0.8821

Daily Low: 0.8741

Trend: Bearish

Resistance

R1: 0.8780 (previous weekly low set on Tuesday)

R2: 0.8789 (100-day SMA)

R3: 0.8816 (Wednesday's daily closing level)

Support

S1: 0.8727 (monthly low touched on June 1)

S2: 0.8700 (horizontal zone, round figure mark)

S3: 0.8681 (April 26 swing low)