EUR/GBP Technical Analysis: Bearish pullback goes on

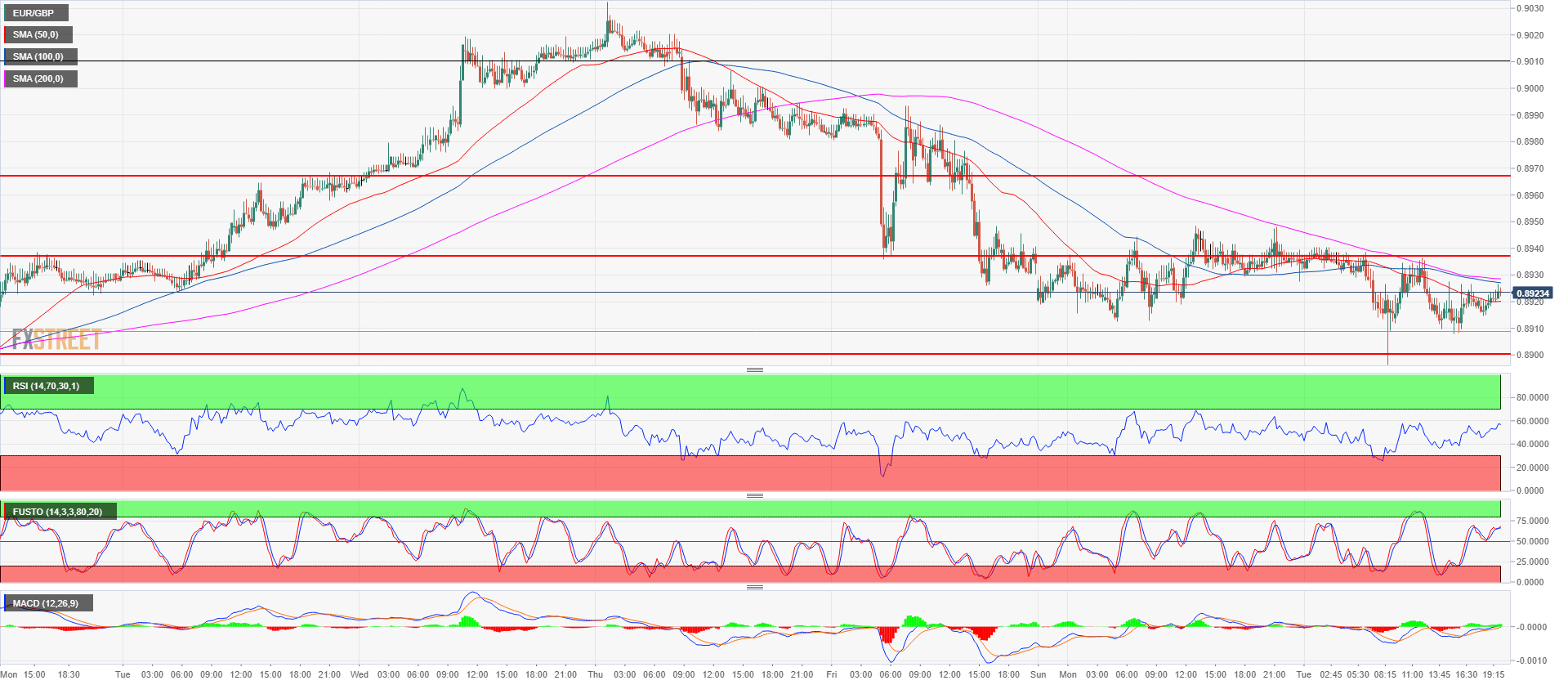

- EUR/GBP is consolidating for the fourth day in a row. Bulls want to resume the bull trend but they need at least convincing break above 0.8937.

- On the flip side, bears want to keep the currency cross below the 200-period simple moving averages on the 15-minute chart and below 0.8937.

- A breakout below 0.8900 can lead to a test of 0.8868 and 0.8840 supply level.

EUR/GBP 15-minute chart

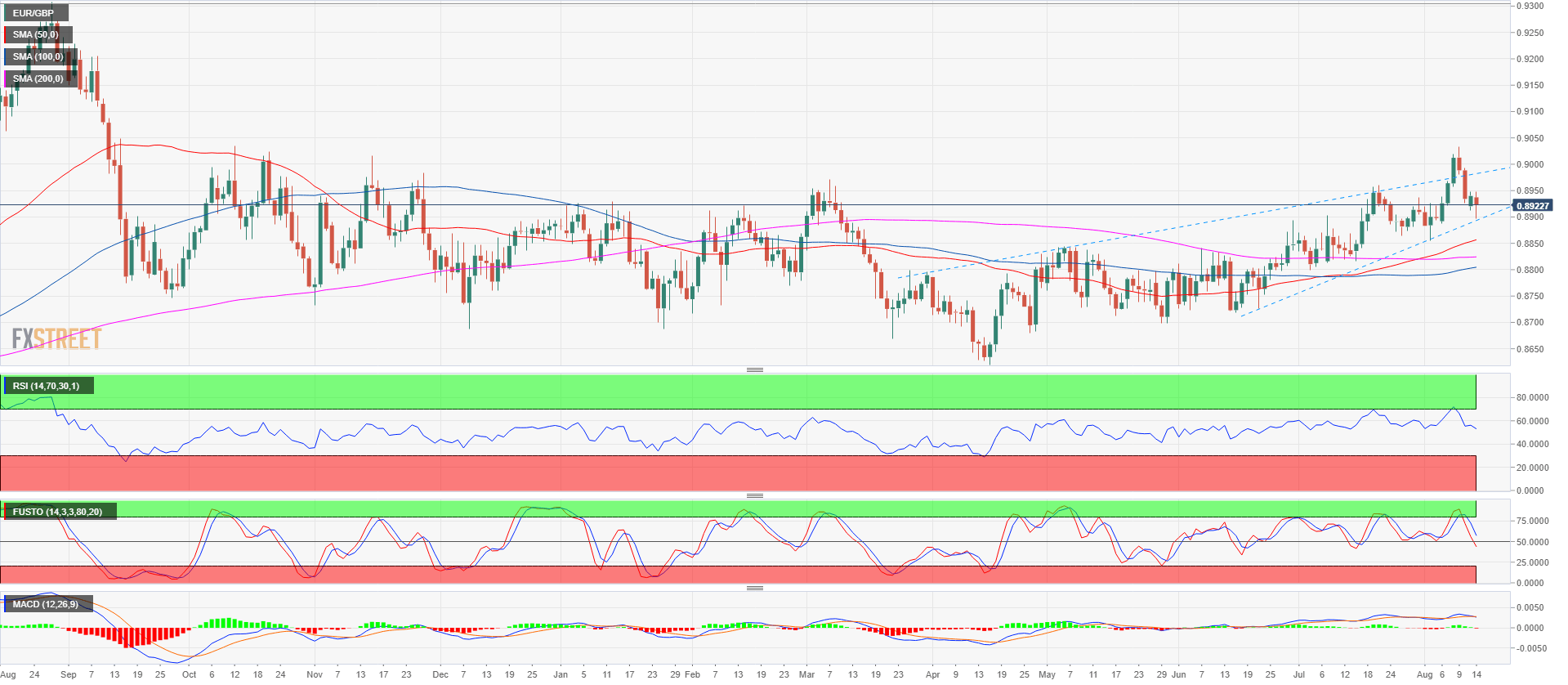

EUR/GBP daily chart

Spot rate: 0.8923

Relative change: -0.19%

High: 0.8948

Low: 0.8896

Main Trend: Bullish

Resistance 1: 0.8937 July 31 high

Resistance 2: 0.8957/67 area, July 20 high and March 7 high

Resistance 3: 0.9019 August 9 high

Resistance 4: 0.9109 September 8, 2017 low

Resistance 5: 0.9160 August 23, 2017 low

Support 1: 0.8920 supply level

Support 2: 0.8900 July 9 high

Support 3: 0.8868, 13 July high

Support 4: 0.8840 supply level

Support 5: 0.8820-0.8840 area, 200-day SMA

Support 6: 0.8800 figure

Support 7: 0.8780 daily 50-period SMA

Support 8: 0.8764 June 8 low