Back

25 Apr 2019

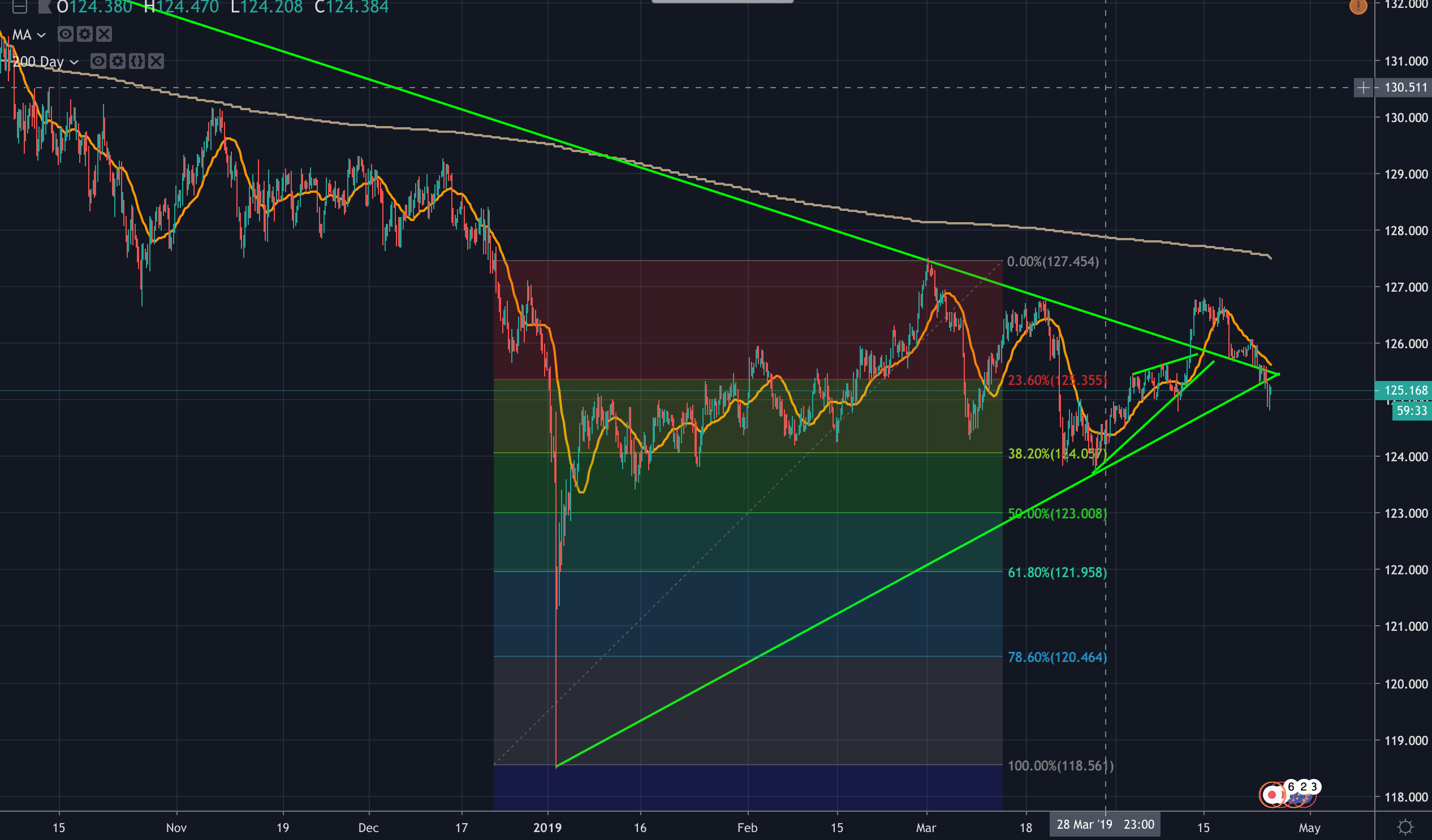

EUR/JPY Technical Analysis: Bears looking into a break of 124.80 for the 38.2% Fibo.

EUR/JPY is non-directional on the charts, with a fake breakout through triangle resistance for bulls looking for more than just the 127 handle and resistance and the 200-DMA.

The cross subsequently fell back to the prior resistance and tested the 23.6% Fibo which gave way to the 124.80s.

On a break of 124.80, risk would be for a subsequent test of trend line support guarding the 38.2% Fibo.

Below 123.40 (Jan 7 and Jan 15 lows) opens of the 50% Fibo at 123.02.

A break there will likely see the price continue in its southerly trajectory, extending last September's bear trend.