Back

9 Aug 2019

EUR/USD technical analysis: Fiber eases from daily highs, trading sub-1.1220 resistance

- Italian political uncertainties could keep a lid on the EUR in the next few days.

- The key level to beat for bears is the 1.1174 support.

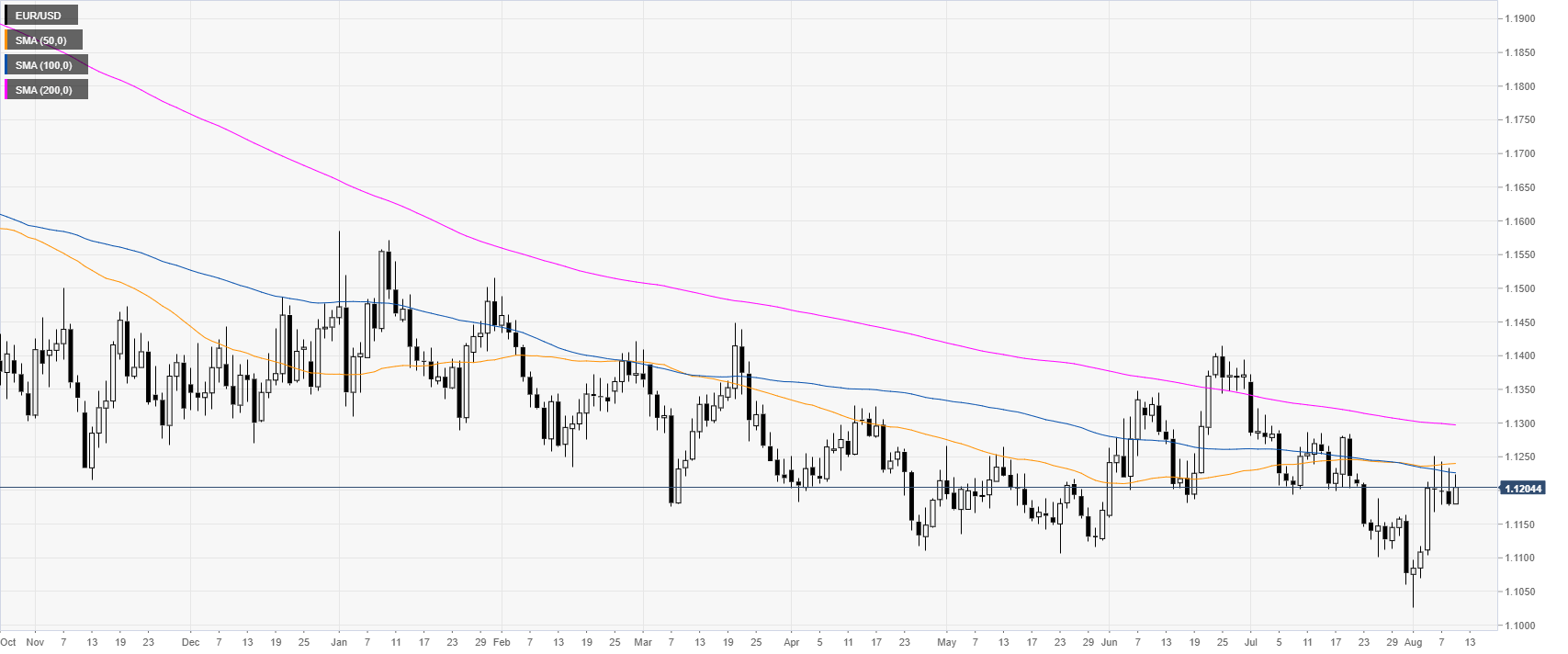

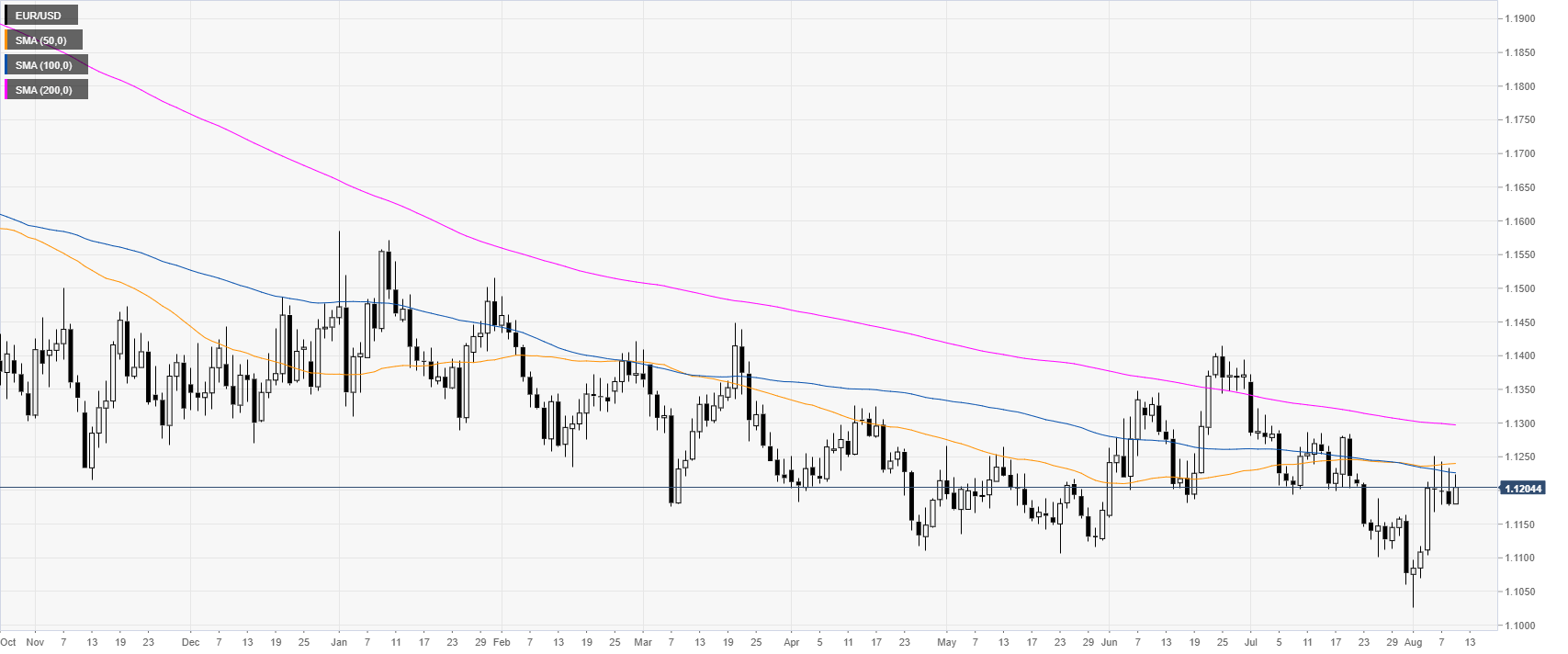

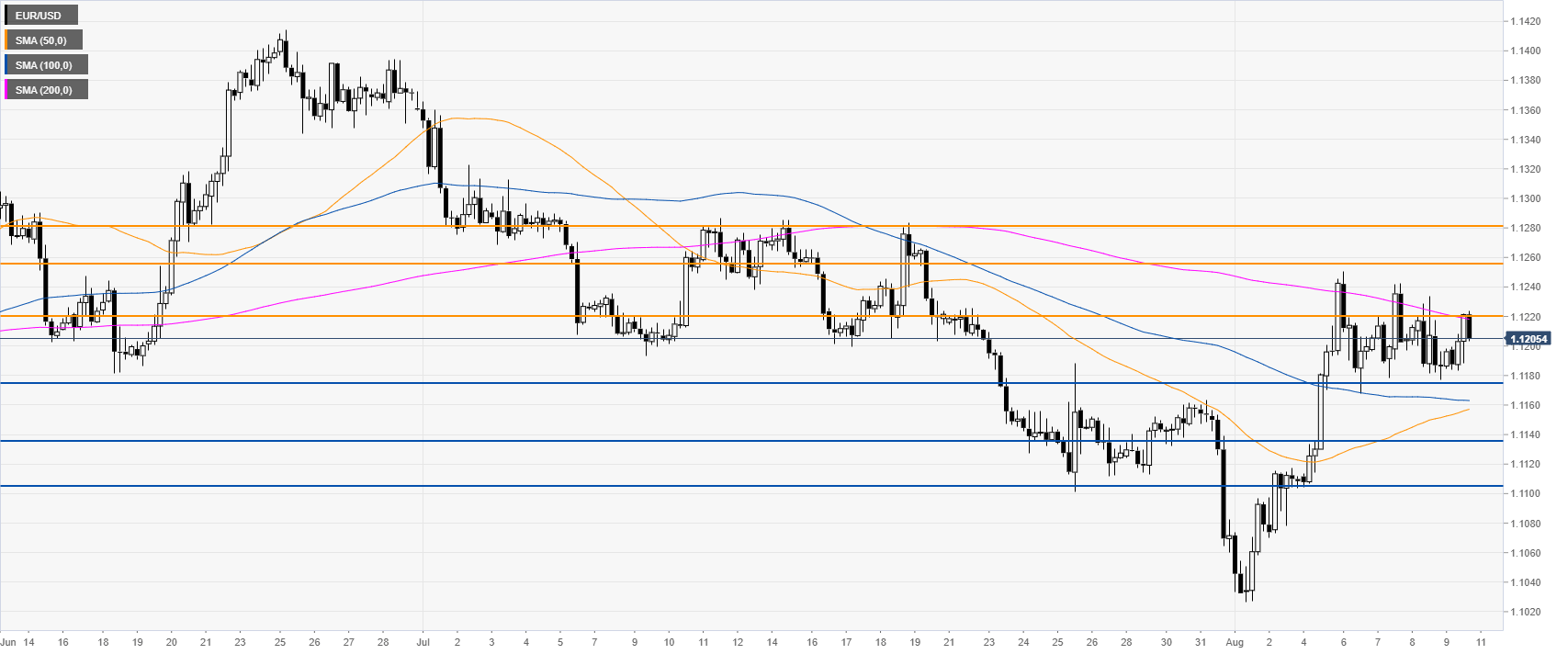

EUR/USD daily chart

EUR/USD is consolidating for the fourth consecutive day the recent move up. The single currency is capped by the 1.1253 resistance and the 50/100-day simple moving averages (DSMAs). The greenback is currently rather flat as the 10-year bond yields are consolidating losses and the US equity market had a notable recovery in the last three days. On the other hand, the sentiment on the EUR is poor due, in part, to political uncertainties in Italy.

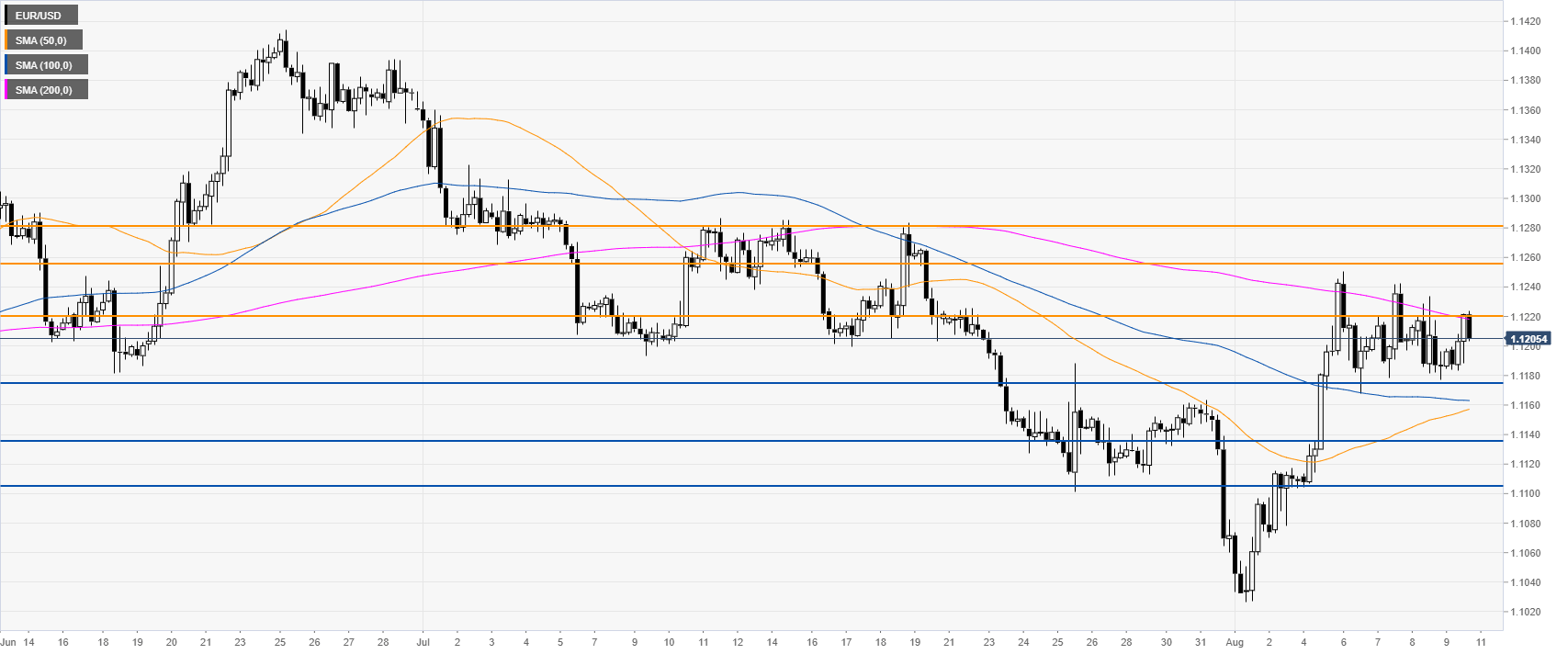

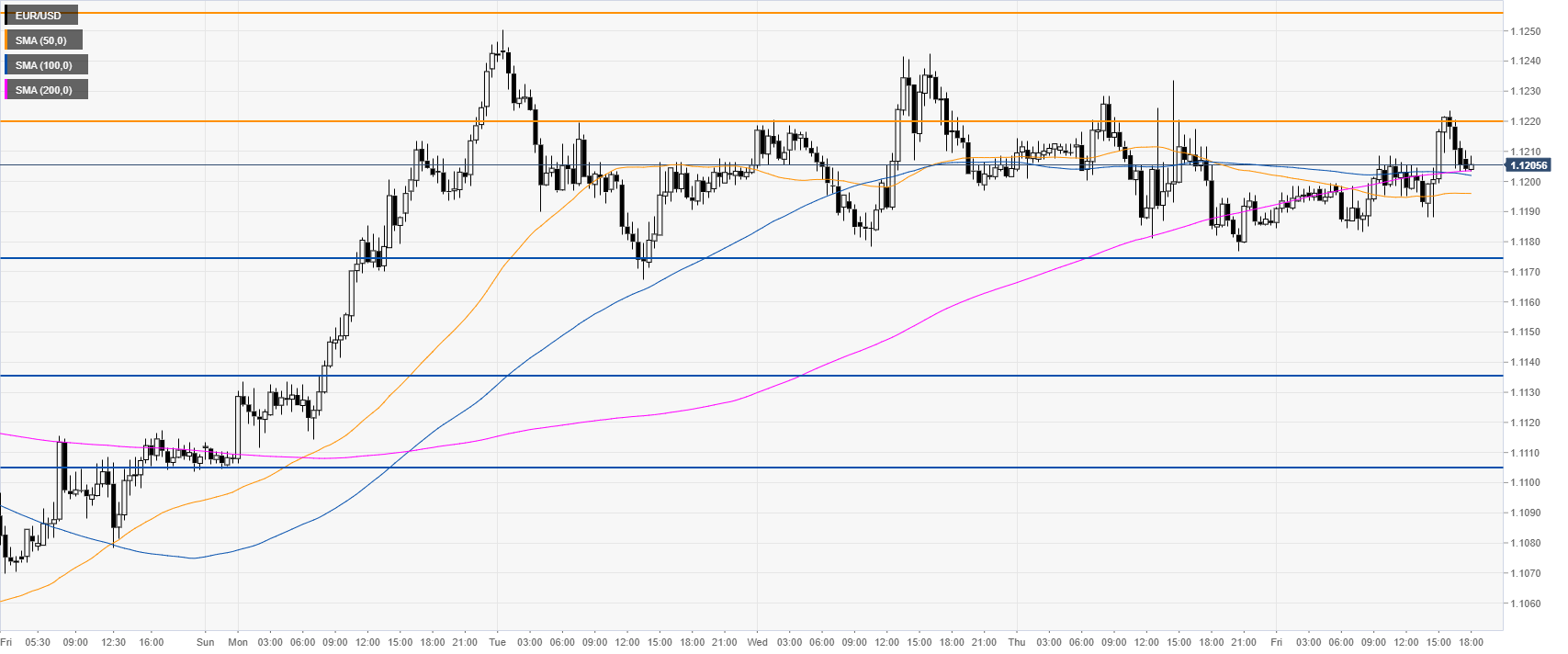

EUR/USD 4-hour chart

The market is currently in a range between the 1.1253 resistance and the 1.1174 while trading below the 200 SMA. Bears would need a clear break below the 1.1174 key support which could lead to a retracement down towards 1.1138 and 1.1105, according to the Technical Confluences Indicator.

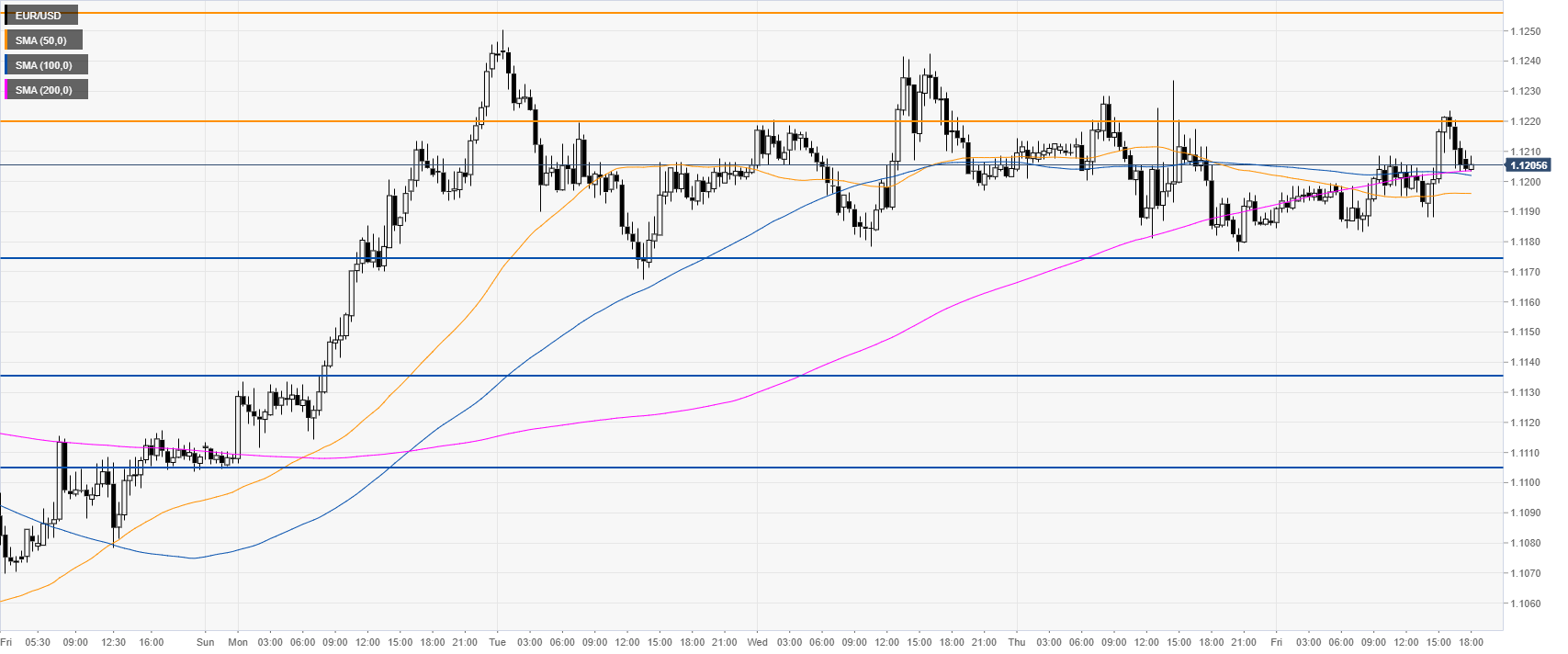

EUR/USD 30-minute chart

The market popped to the 1.1220 resistance but found no acceptance above the level. Buyers need a daily close above 1.1220 and 1.1253 to climb towards 1.1282 resistance, according to the Technical Confluences Indicator.

Additional key levels