Back

6 Dec 2019

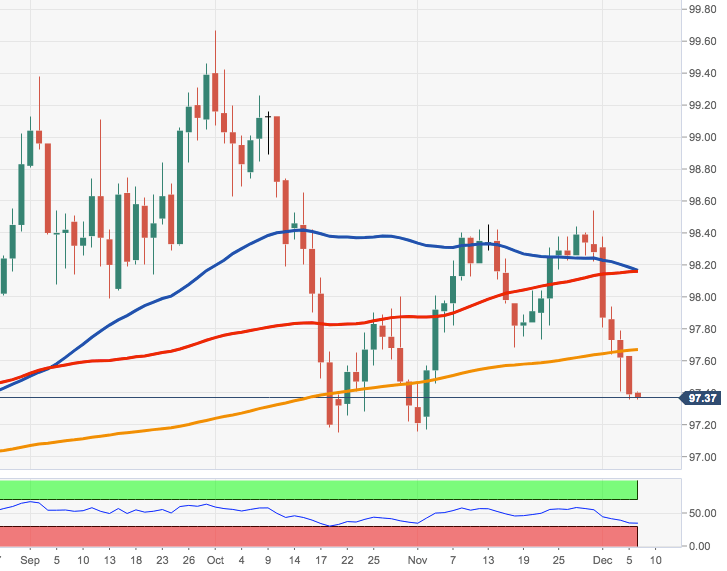

US Dollar Index Technical Analysis: Rising bets for a move to 97.00

- DXY stays depressed in the area of multi-week lows.

- The 97.00 neighbourhood now emerges on the horizon.

DXY is prolonging the leg lower to the 97.40/35 band at the end of the week, losing ground for the sixth session in a row so far.

The recent breakdown of the key 200-day SMA in the 97.60/65 band has opened the door for a deeper retracement to, initially, October and November peaks in the 97.10 area ahead of 97.03 (August low).

On the upside, the critical 200-day SMA (97.64) has now become a significant hurdle. Above it, the index should regain the constructive outlook.