Back

20 Jan 2020

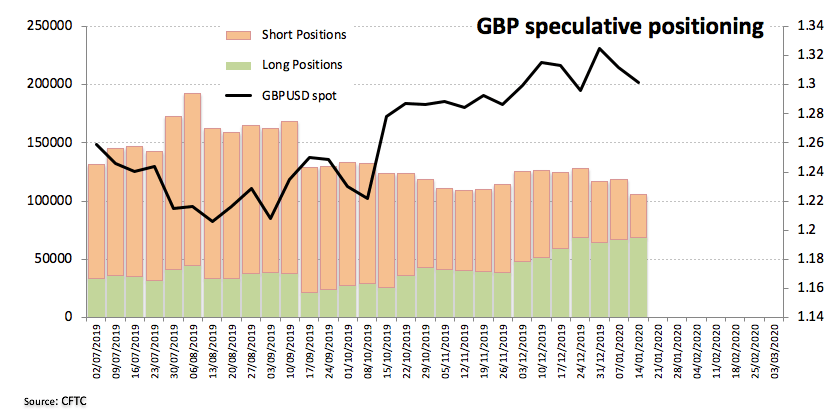

CFTC Positioning Report: GBP net longs in highest level since April 2018

These are the main highlights of the latest CFTC Positioning Report for the week ended on January 14th:

- Net longs in the sterling climbed to the highest level since late April 2018 on the back of rising optimism regarding negotiations for a EU-UK trade deal, expected to kick in later in the year. The recent dovish comments from BoE officials (following the cut-off date) weighed on the pound in the second half of the week and would surely be reflected in the next report.

- Easing geopolitical concerns, mainly in the Middle East, have been sustaining the exodus from the safe haven universe and echoed on the higher net short position in the Japanese yen.

- EUR net shorts retreated to the lowest level since late August 2019, as speculations on a better performance of the region this year appear to support investors’ sentiment.