NZD/USD: Bulls waiting for CPI and subsequent price action to marry COT bias

- NZD/USD has stuck to a narrow 0.6585-0.6610 range as markets get set for Aussie data ahead of NZ Q4 CPI.

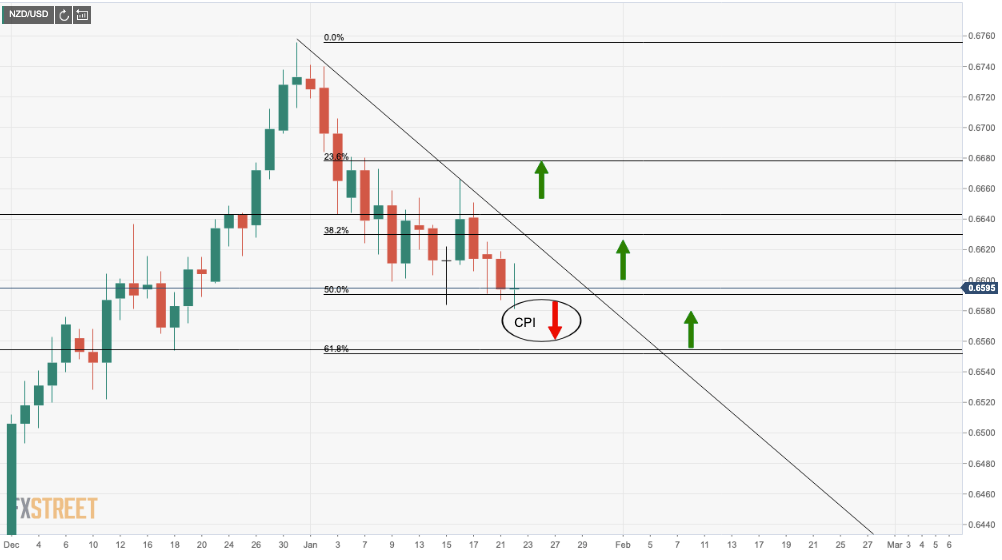

- NZD/USD is currently consolidating on a 38.2% Fibonacci retracement of the weekly 2nd Dec 2019 impulse, (Bullish).

- NZD COT data has been bullish, in tow with the weekly price action, (daily price action, just a healthy correction).

The pair traded in a narrow 0.6585-0.6610 range as traders get set for what could be a real game-changer for both the antipodeans in economic data. Firstly, in the Asian session for 23rd Jan, the unemployment number for Australia will be a critical focus, especially given the technical picture for the Aussie. Should there be a disappointment, considering the geopolitical environment, bushfires and a dovish prospect in the Reserve Bank of Australia, the currency could come under immense selling pressure and drag the kiwi for the ride as well.

Markets are focussing heavily on central bank policies and there is an overwhelmingly dovish bias when it comes to the RBA, but not so much for the Reserve Bank of New Zealand – this is what makes tomorrow's Consumer Price Index all that more critical. We will get NZ quarter-four data which follows 0.7% QoQ in Q3, that was stronger than the market or RBNZ expected, although the RBNZ’s focus will remain on the slowing economy, which should see inflation continue to fall short over this next year.

CPI is critical due to seasonality

However, if annual inflation coms in above the 1.8% expected, and closer to the Reserve Bank's 2% target midpoint, the bird should get a lift. Anything below the mark will be a huge disappointment given the seasonality whereby inflation would be expected to firm in the December quarter. "The biggest positive contribution typically comes from the travel-related categories, with large increases in airfares, accommodation and car rentals over the holiday period," analysts at Westpac argued.

NZD/USD levels, a bullish scenario using COT

Bulls are taking charge again within the weekly bullish impulse with an intermittent series of lower lows on the four-hour time frame making a support structure on the 38.2% Fibonacci retracement of the weekly 2nd Dec 2019 following a second attempt to break below it by the bulls – (15th Jan lows). This is also a daily 50% Fibo (reinforcing the support).

When we look to the COT data, we can see that despite the downtrend in the Kiwi in 2020, since 10th Dec, shorts had been decreasing their shorts from 39773 to 24446 and Longs had been increasing their longs from 14433 to 24085. This would indicate that the bird is in the midst of a healthy correction and can continue higher at this juncture, data-dependent (tomorrow's CPI) and following subsequent price action. There is also risk of a turn down towards the golden ratio of 61.8% confluence level in the 0.6550s before the upside might be considered again.

However, at this point, bulls need a jump above trendline resistance at 0.6643 before taking aim at the Jan 16th high of 0.6665 for a bullish entry point and subsequent stop at prior support, 0.6580. We may not see a clean break-out. Bulls can target the mid-July highs in 0.68 the figure which meets with May and Nov 2017 double bottom lows, although the -27% Fibo target of the newly projected impulse point at 0.6665 coms in slightly below there at 0.6785.