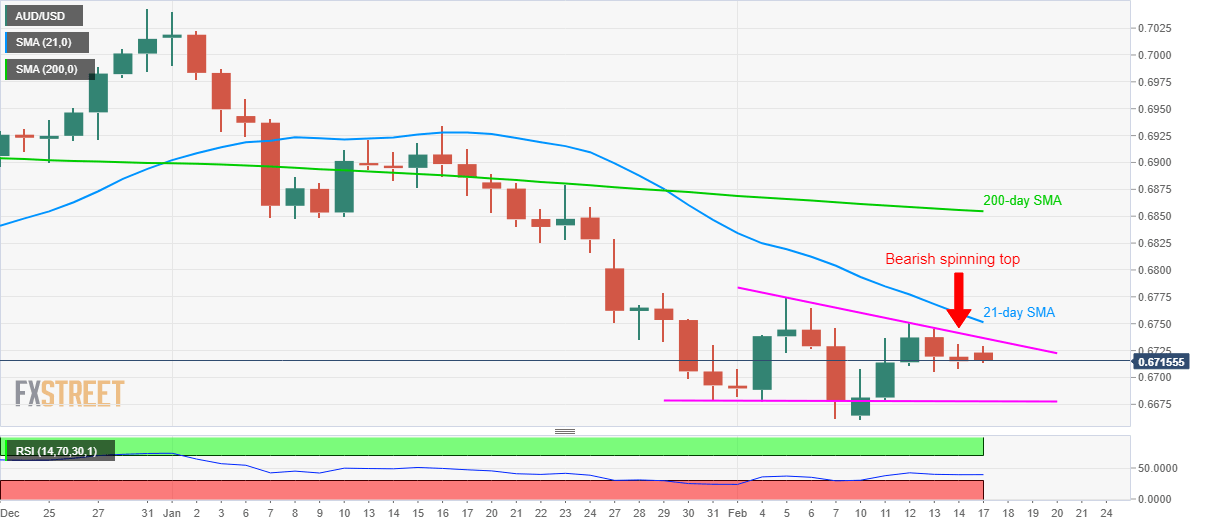

AUD/USD Price Analysis: Under pressure following Friday’s bearish spinning top

- AUD/USD registers three-day losing streak.

- A bearish candlestick formation, sustained trading below short-term trend line keep sellers happy.

- Lows marked around 0.6680 can offer intermediate support.

AUD/USD drops to 0.6717, -0.03% with an intra-day low of 0.6715, by the press time of early Monday. In doing so, the pair justifies a bearish candlestick formation portrayed on Friday while also extending the weakness below an eight-day-old resistance line and 21-day SMA.

With this, sellers are on the lookout for the downside break of 0.6700 to target multiple supports around 0.6680, a break of which could recall the monthly low, also a decade bottom, surrounding 0.6660.

If at all prices keep trading southwards past-0.6660, the bears wouldn’t mind aiming for 0.6600 round-figure.

On the flip side, the immediate resistance line and 21-day SMA, respectively around 0.6740 and 0.6755, could restrict the pair’s near-term pullbacks.

Should there be a further recovery beyond 0.6755, January 29 high near 0.6780 and multiple lows marked during early-January close to 0.6850 will return to the charts.

AUD/USD daily chart

Trend: Bearish