Back

28 Apr 2020

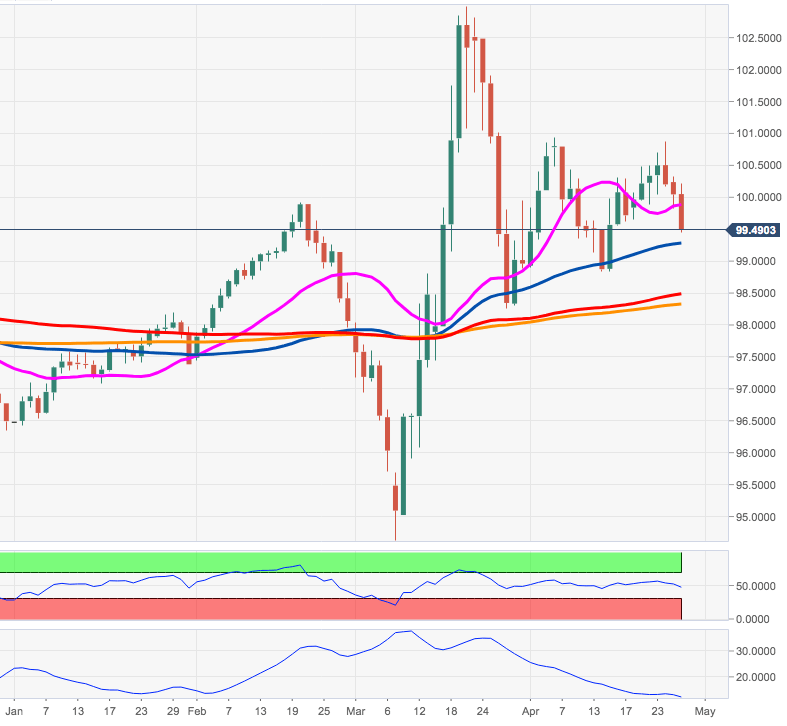

US Dollar Index Price Analysis: Further downside could see 98.80 re-tested

- DXY is weaker and extends the move lower to the 99.50 area.

- Next on the downside is located the 55-day SMA near 99.30.

DXY is prolonging the leg lower so far this week, particularly after breaking below the key support the psychological 100.00 mark.

If the selling impetus gathers extra steam, then the next interim support is located at the 55-day SMA, today at 98.28. Further down aligns the more relevant 98.85/80 band, or monthly lows.

In case sellers increase their presence, a test of the 200-day SMA, today at 98.31, should not be surprising in the near-term.

DXY daily chart