USD/IDR Price News: Indonesian rupiah keep the strength near six-week top

- USD/IDR stays depressed near the six-week low.

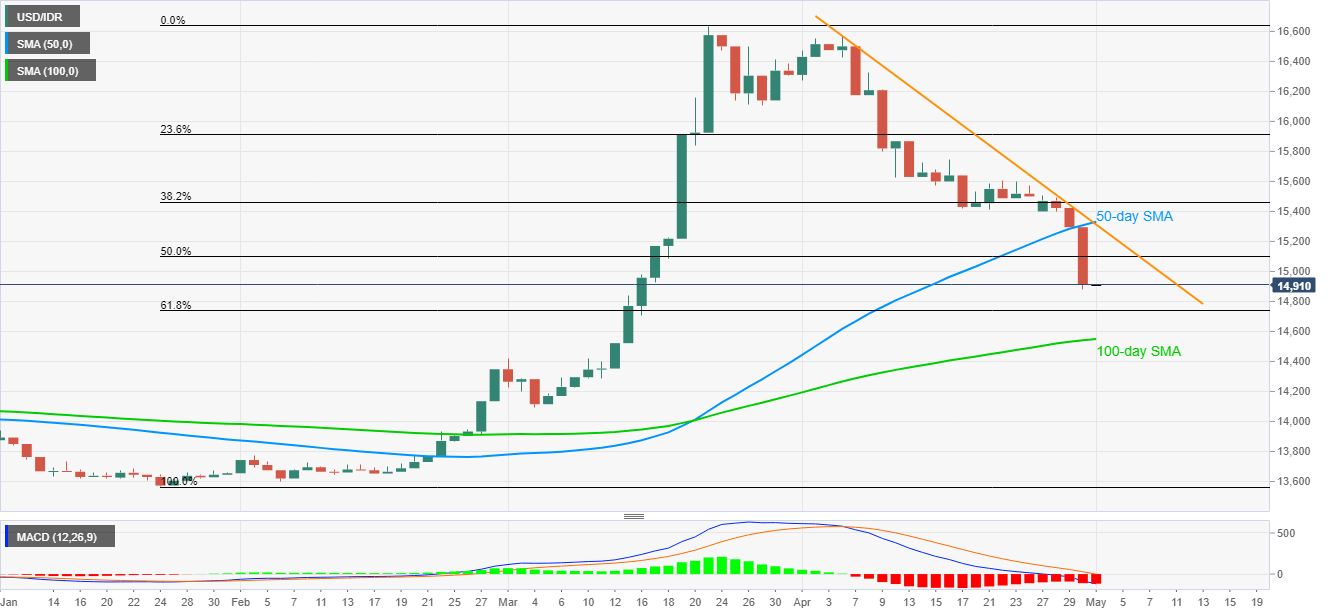

- 61.8% Fibonacci retracement, 100-day SMA on sellers’ radar.

- A confluence of 50-day SMA and monthly falling trend line guards recovery moves.

USD/IDR remains pressured near the six-week low, around 14,910, ahead of the European session on Friday.

The pair’s latest break below 50-day SMA, as well as bearish MACD, keeps the sellers directed towards 61.8% Fibonacci retracement of January-March upside, near 14,740.

However, 100-day SMA, at 14,550 now, could restrict the pair’s further downside, if not then the early-March top near 14,420 will return to the charts.

On the upside, buyers are less likely to enter unless clearing a confluence of 50-day SMA and monthly resistance line, around 15,330.

If at all the bulls manage to cross 15,330 on a daily closing basis, 15,610 and 23.6% Fibonacci retracement level of 23.6% Fibonacci retracement near 15,900 can offer intermediate halt during the quote’s anticipated rally towards 16,000 mark.

USD/IDR daily chart

Trend: Bearish