Back

26 May 2020

S&P 500 Price Analysis: US stocks break to fresh 2.5-month highs above the 3000 mark

- The bullish recovery sees the market trade in fresh 2.5-month highs.

- The S&P 500 breaks above the 3000 critical resistance.

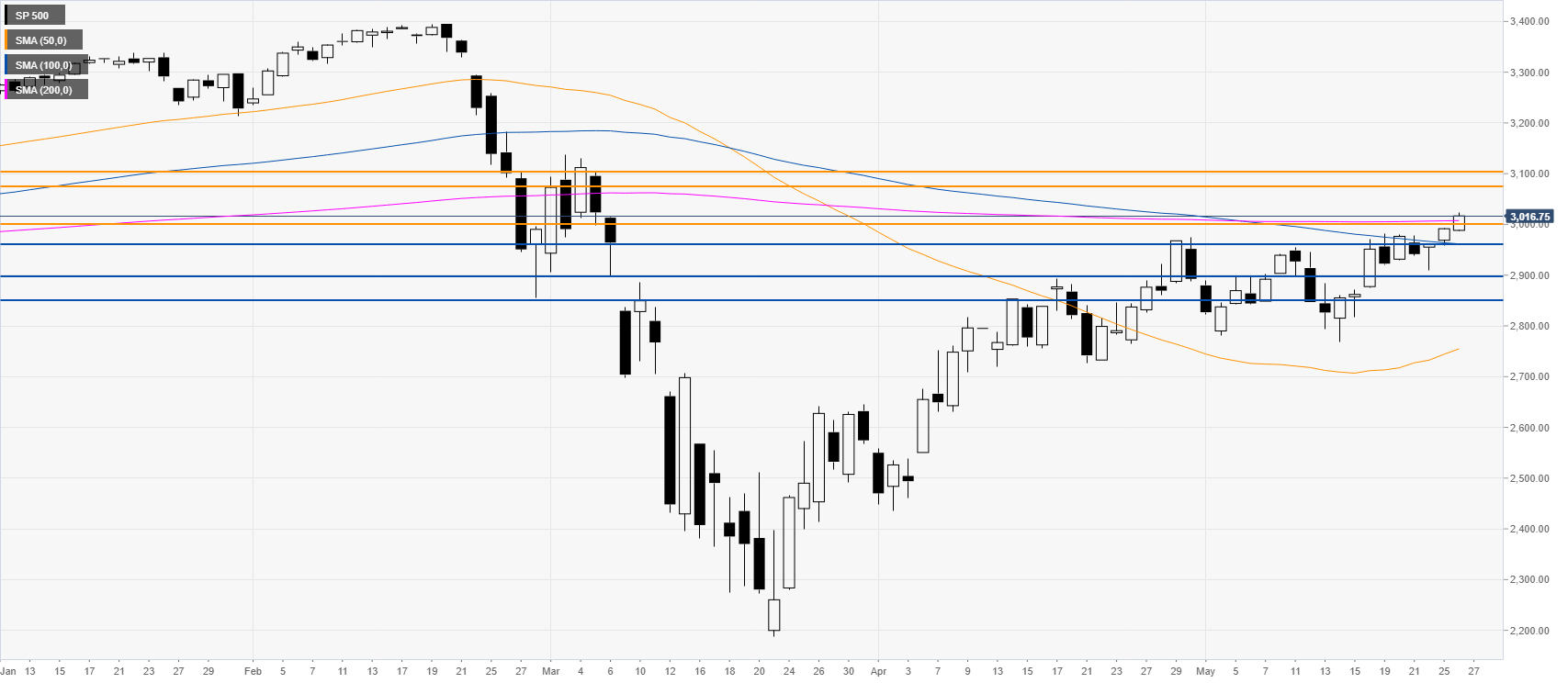

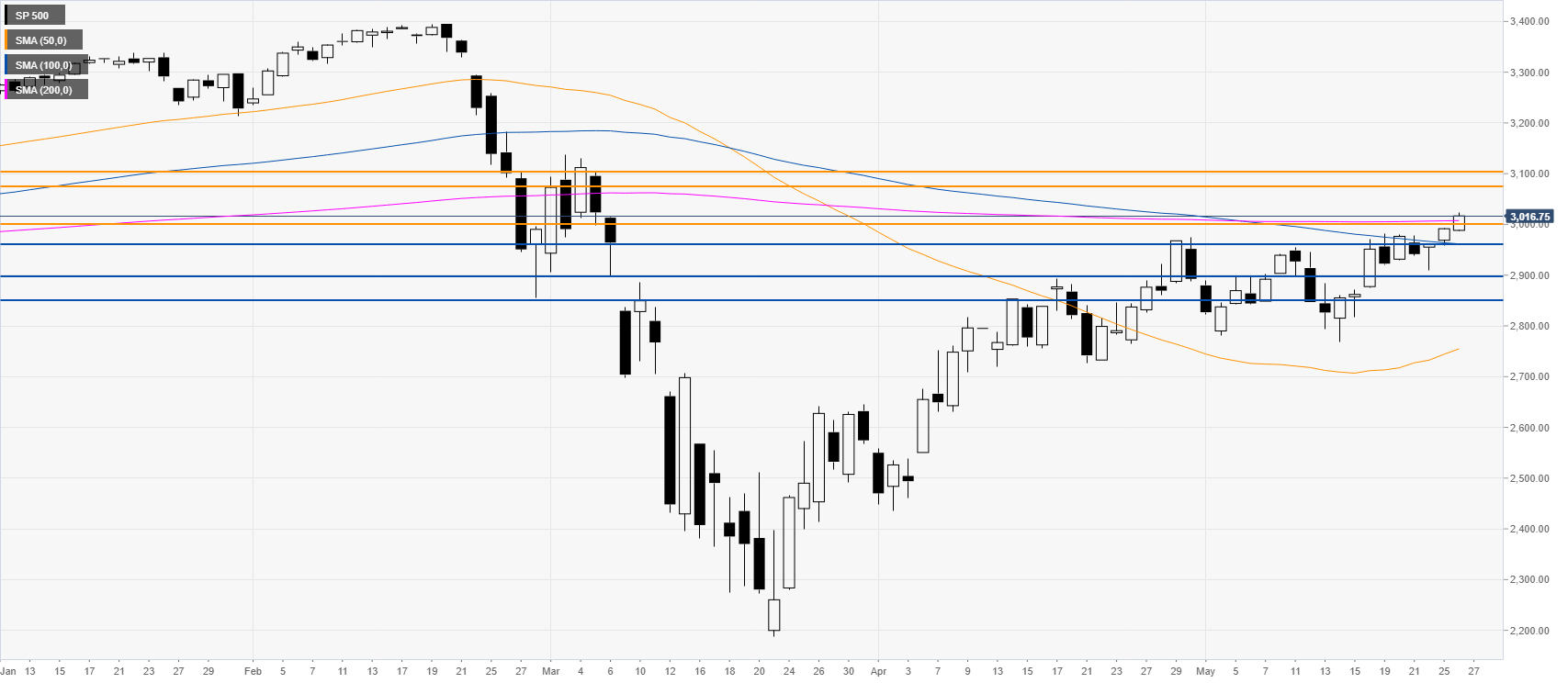

S&P 500 daily chart

Following the February-March crash, the S&P 500 is recovering most of its losses. The index is trading in fresh 2.5-month highs above the main SMA on the daily chart. As buyers broke the critical 3000 mark, a run to the 3075/3100 price zone in the medium-term cannot be ruled out. On the other hand, support can emerge the 2960 and 2900 levels initially.

Additional key levels