Back

15 Jun 2020

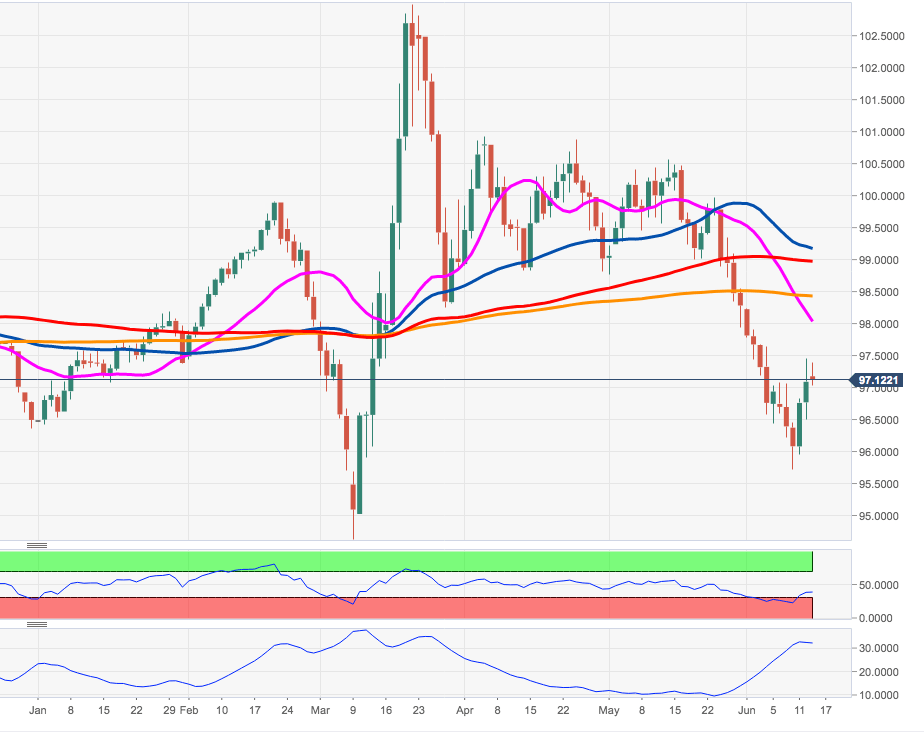

US Dollar Index Price Analysis: Next target emerges at the 98.40 region

- DXY keeps the recovery-mode unchanged at the beginning of the week.

- The next target of relevance appears at the 200-day SMA at 98.42.

The rebound in DXY has reclaimed the 97.00 mark so far and is looking to extend the move further north at the time of writing.

Immediately to the upside emerges the Fibo level (of the 2017-2018 drop) at 97.87 ahead of the more relevant 200-day SMA, today at 98.42.

While capped by this area, further losses are expected in the dollar in the near-term.

DXY daily chart