USD/CAD Price Analysis: Bull pennant breakout on 1H calls for further upside

- USD/CAD looks to extend the recent recovery rally beyond 1.36.

- Bull pennant breakout on hourly sticks, with bullish RSI.

- Canadian jobs, US PPI and coronavirus status to hog the limelight.

USD/CAD is back under the 1.3600 level following an uptick seen in early trades, as the risk-off sentiment remains the key theme in Asia this Friday, keeping the US dollar broadly bid.

Meanwhile, the losses in the major could be capped by the 0.50% drop in WTI prices, which weighs on the resource-linked Loonie.

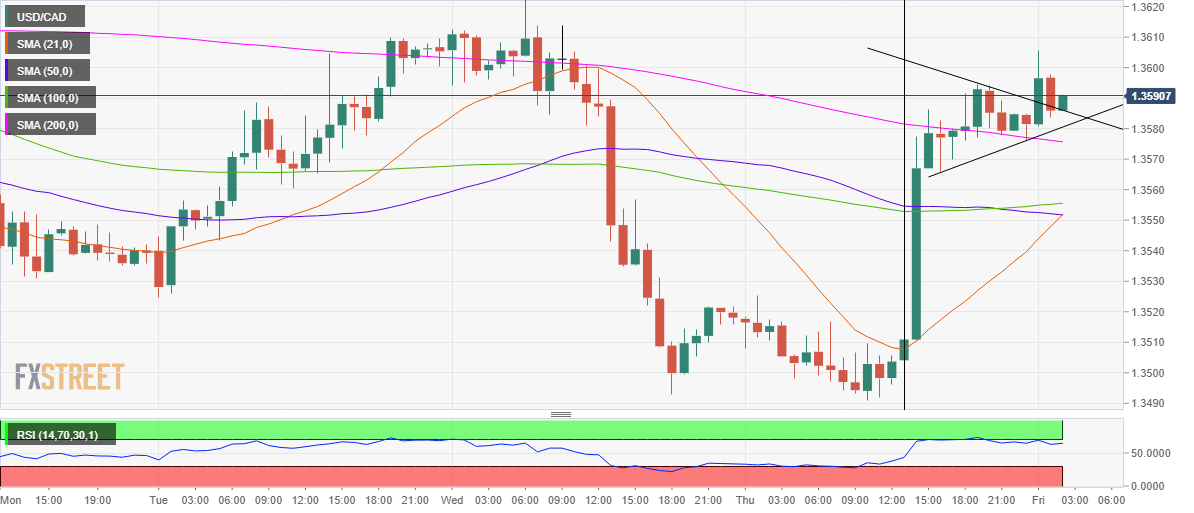

Further, the technical set-up on the hourly chart also suggests that the path of least resistance appears to the upside. The spot has charted a bullish pennant breakout following an hourly close above the falling trendline resistance at 1.3588.

The bullish formation calls for a test of the pattern target near 1.3650 should the Canadian jobs disappoint and or the US dollar continue to draw safe-haven bids.

The upside bias is backed by the hourly Relative Strength Index point upwards at 66.65, just below the overbought territory. The rally in the major picked up pace only after the price cut the 21-hourly Simple Moving Average (HMA) from below in Thursday’s NY trading.

To the downside, any pullbacks could be capped around 1.3580, where the 200-HMA and rising trendline support coincide.

A break below the latter could trigger a sharp drop towards 1.3555-50 region, the strong confluence of the 50, 100 and 21-HMAs.

USD/CAD hourly chart

USD/CAD additional levels