Silver Price Analysis: Upside momentum fizzles near multi-year high below $20.00

- Silver prices take rounds to $1,987/93 after refreshing the highest level since September 2016.

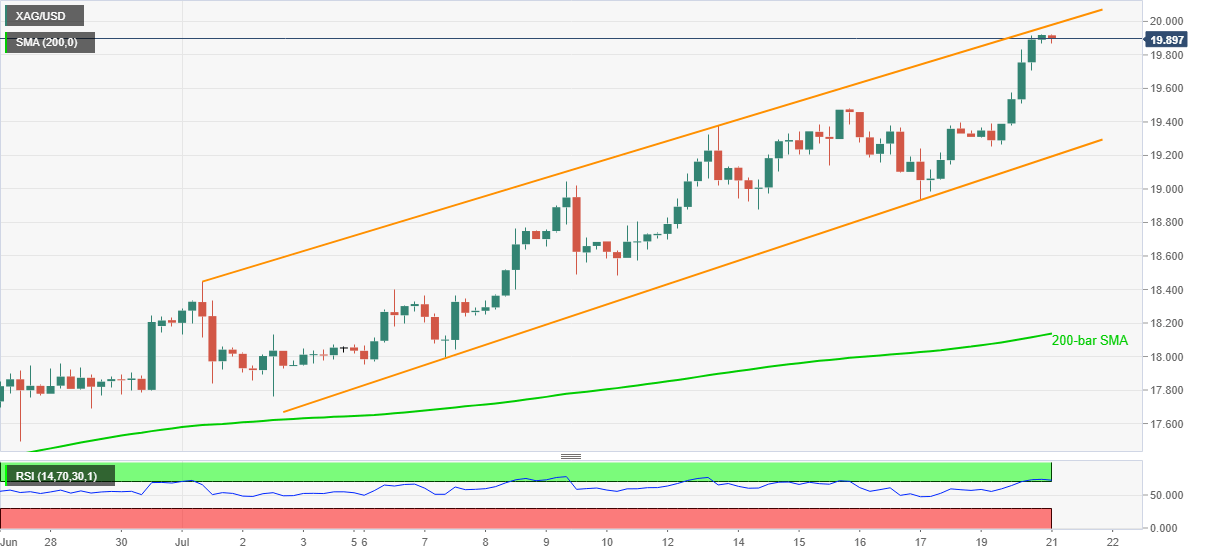

- The resistance line of the monthly ascending channel restricts immediate upside beyond the $20.00 threshold.

- The mid-month top can act as nearby support ahead of the channel’s lower line.

- Overbought RSI conditions favor pullback from a multi-month peak.

Silver trades around $19.90 amid the initial hour of Tokyo open on Tuesday. The white metal surged to the highest since late-2016 the previous day. However, overbought RSI conditions stopped bulls from meeting the $20.00 round-figures.

Hence, the bullion may witness additional declines targeting Wednesday’s high of $19.48. However, the support line of an upward sloping channel since July 01, near $19.20, will question the metal’s further selling.

Should there be a clear downside past-$19.20, $19.00 and 200-bar SMA level of $18.13 will be in the spotlight.

Meanwhile, the mentioned channel’s resistance line adds strength to the $20.00 threshold, a break of which will enable the bulls to challenge September 2016 high of $20.13.

Additionally, August 2016 peak close to $20.80 and the all-time record of $21.14 could lure the optimists past-$20.13.

Silver four-hour chart

Trend: Pullback expected