Back

24 Jul 2020

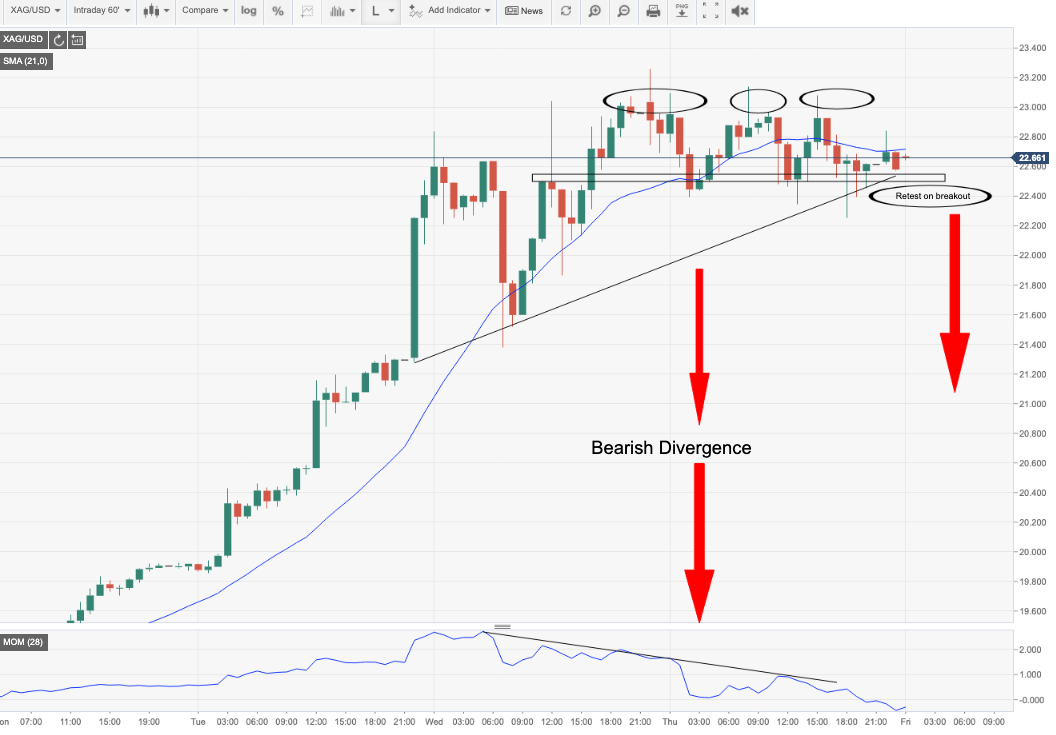

Silver Price Analysis: Bears waiting for short trade setup below support structure

- Silver is consolidating and not showing any signs of conviction either way.

- Bears need the price to break structure and greatest it with failures to tilt the short-term bias in their favour.

Silver is reluctant to go down although a triple-top is now in play on the hourly chart which adds weight to the bearish case.

In the New York session, signs were emerging that the plug was about to be pulled on the bull's quest for higher highs with a slide below trendline support:

- Silver Price Analysis: 1-HR Momentum divergence, bulls losing steam in bullish territory

At this juncture, a triple top seems to be in play as the struggles to get into gear in a phase of consolidation.

We have bearish divergence as well, illustrated in the chart below.

However, there are no real bearish confirmations as yet, so there are no compelling bias either way in the near term from an hourly perspective until we see a break of the support structure confirmed by a retest of structure.