Back

2 Sep 2020

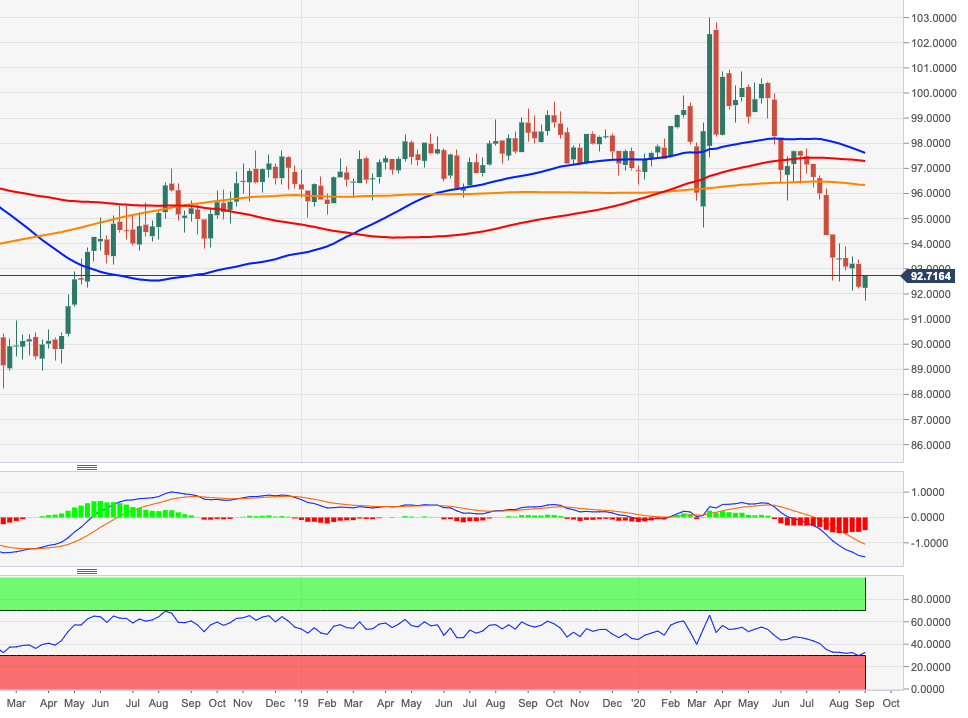

US Dollar Index Price Analysis: Rebound seen faltering near 94.00

- DXY reverses Tuesday’s drop to fresh lows near 91.70.

- Further recovery is probable, but solid hurdle awaits near 94.00.

DXY retreated to levels last seen in April 2018 in the 91.75/70 band on Tuesday. The downtick, however, failed to extend further south and sparked a moderate recovery to the 92.00 mark and beyond instead.

That said, the ongoing recovery carries the potential to progress further, although it is expected to run out of steam in the vicinity of the key resistance in the 94.00 neighbourhood. The resumption of the selling bias should prompt DXY to recede to the April 2018 low at 89.23 ahead of the March 2018 low at 88.94.

The offered stance in the dollar is expected to remain unchanged while below the 200-day SMA, today at 97.45.

DXY weekly chart