Back

25 Feb 2021

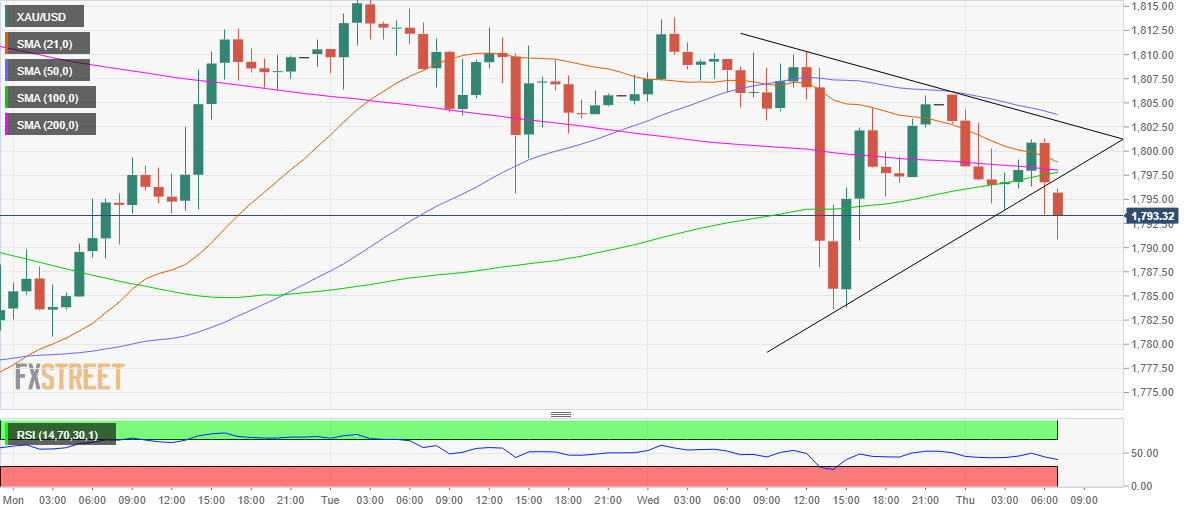

Gold Price Analysis: XAU/USD eyes $1770 amid symmetrical triangle breakdown

- XAU/USD spots symmetrical triangle breakdown on the 1H chart.

- RSI point south, within the bearish zone, allowing more declines.

- Downside more compelling amid a bunch of healthy resistance levels.

Gold (XAU/USD) eyes deeper losses, as the rally in the US Treasury yields picks up pace in European trading.

Despite closing Wednesday above the $1800 level, the bears retain control amid a technical break to the downside on the hourly chart.

The price of Gold confirmed a symmetrical triangle breakdown on the said timeframe after delivering an hourly close below the rising trendline support at $1796.

The bearish break calls for a retest of Wednesday’s low at $1784, below which the measured target at $1770 could be challenged.

The downside bias also got additional credence after the price breached the critical cushion around $1798, where the 200, 100 and 21-hourly moving averages (HMA) converge.

more to come ...