EUR/USD clings to gains above 1.1900 post-data

- EUR/USD keeps the trade above the 1.19 level on Tuesday.

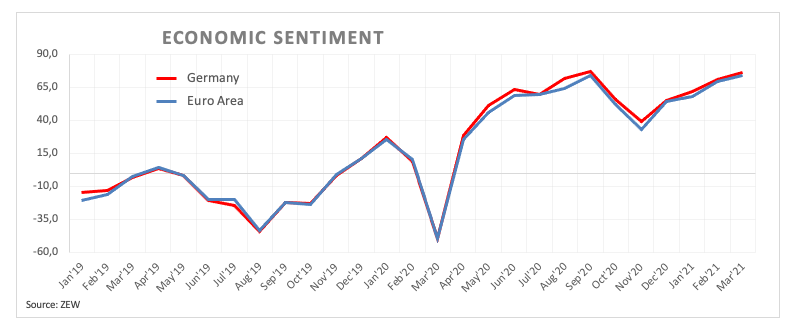

- The German Economic Sentiment improved to 76.6 in March.

- US Retail Sales, Industrial Production next in the calendar.

The single currency alternates gains with losses and motivates EUR/USD to keep the daily range above the 1.1900 yardstick.

EUR/USD looks to dollar, yields

EUR/USD attempts a recovery from recent lows in the 1.1900 neighbourhood on the back of some profit taking in the greenback and the steady performance of US yields.

Indeed, the 10-year benchmark extends the consolidative mood around the 1.60% area so far on turnaround Tuesday and appears to remove part of the recent strength in the buck.

Also supporting the now better momentum in the euro, the Economic Sentiment in both Germany and the broader Euroland improved to 76.6 and 74.0, respectively, for the month of March when tracked by the ZEW survey. Later in the session ECB’s Board members De Guindos, af Jochnick and A.Enria will participate in virtual events.

Across the pond, the 2-day FOMC meeting kicks in later. In the calendar, advanced Retail Sales will take centre stage seconded by Industrial Production, the NAHB Index and Business Inventories.

What to look for around EUR

EUR/USD met a tough resistance in the proximity of the psychological 1.20 hurdle in past sessions. The persistent solid stance in the greenback in recent weeks has put the previous constructive view in the euro under scrutiny, as market participants continue to adjust to higher US yields and the outperformance of the US economy narrative. However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair.

Key events in Euroland this week: Final February EMU CPI (Wednesday) – ECB’s Lagarde speech (Thursday).

Eminent issues on the back boiler: ECB action to curb rising European yields. EUR appreciation could trigger ECB verbal intervention, especially amidst the future context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Still huge long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.07% at 1.1933 and a break above 1.1989 (weekly high Mar.11) would target 1.2084 (50-say SMA) en route to 1.2113 (monthly high Mar.3). On the flip side, the next support emerges at 1.1835 (2021 low Mar.9) seconded by 1.1834 (200-day SMA) and finally 1.1762 (78.6% Fibo of the November-January rally).