EUR/USD Price Analysis: Multiple hurdles to test bulls

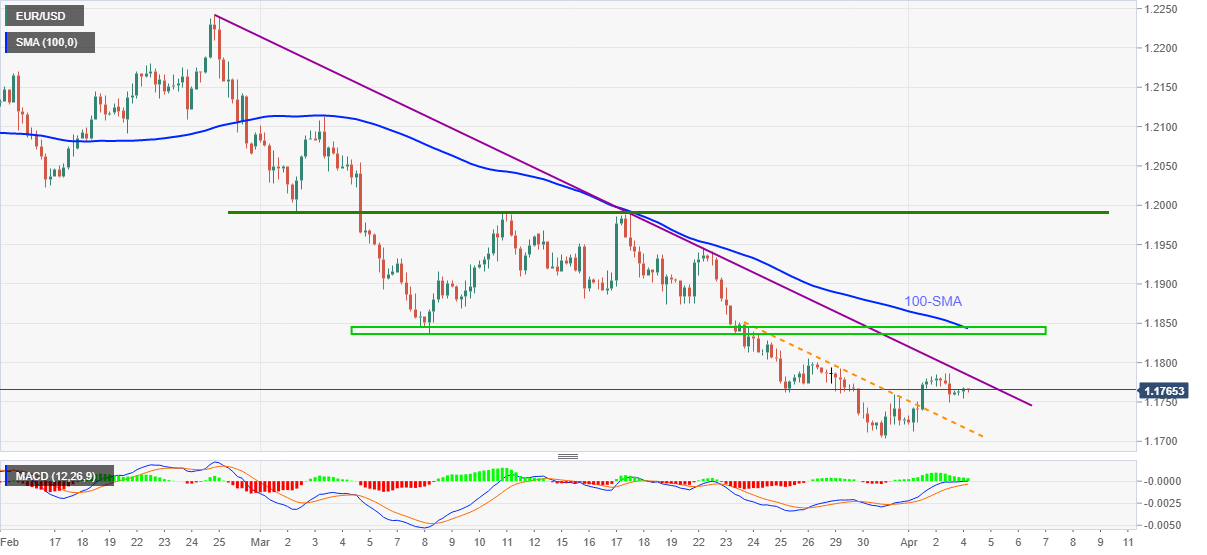

- EUR/USD prints mild gains, extends Thursday’s breakout of short-term resistance line.

- Descending trend line from February 25 guards immediate upside ahead of the key 1.1835-45 resistance-zone.

- Resistance-turned-support, March’s low challenge bears targeting November 2020 low.

EUR/USD wavers around 1.1765 amid a quiet Asian session on Monday. Even so, the quote keeps last week’s upside break of an eight-day-old falling trend line.

It should, however, be noted that the receding bullish bias of the MACD and a multi-day-long resistance line around 1.1785 could challenge the EUR/USD bears.

Even if the quote manages to cross the 1.1785 immediate hurdle, a horizontal area comprising the early March lows and 100-SMA around 1.1835-45 will be a tough nut to crack for EUR/USD buyers.

Additionally, March 02 low and highs marked during March 11 and 18 offer an upside filter to the north around 1.1990-95.

On the flip side, the previous resistance line around 1.1715 and March’s low, also the yearly bottom, surrounding 1.1700, will be the key levels to watch before November 2020 trough near 1.1600.

EUR/USD four-hour chart

Trend: Pullback expected