AUD/USD Price Analaysis: A countertrend trader's setup in the making?

- AUD/USD bears have taken over, but there are bullish prospects from here.

- The price would now be expected to correct a significant portion of the drop in the sessions ahead.

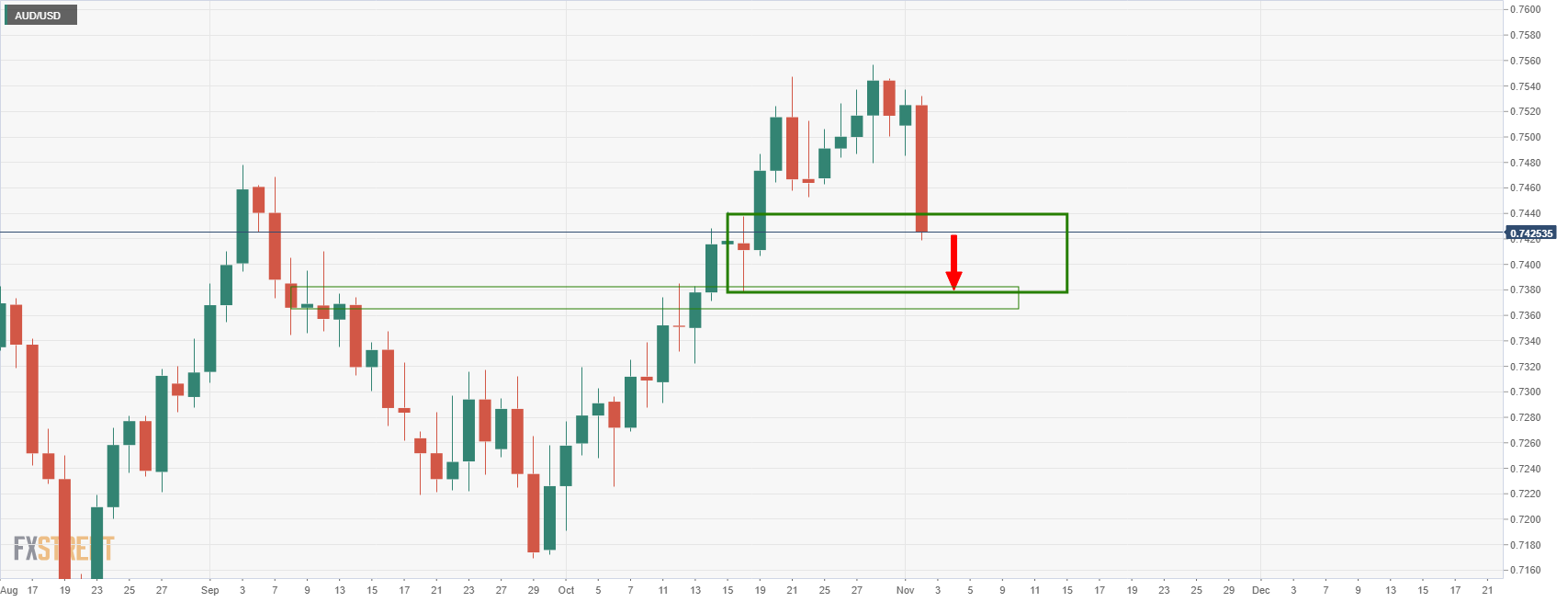

The price has run into what would be expected to be a strong area of support and given the imbalance, a correction is the most probable next scenario. Looking back at the price action, it would appear that there is a huge imbalance all the way back to the 0.7450s. This also coincides with a 61.8% Fibonacci as well as a smoothed 200 hourly moving average.

That is not to say that the price can necessarily reach that far immediately, but bulls will be aware of that area of liquidity and will potentially want to target there in due course.

From a 15-min perspective, the 0.7440s is a more probable level that could be more easily achieved in the short term:

As illustrated, the 21-EMA meets with this area of potential interest and the drop from there was sudden, so there is some mitigation that needs to happen which most probably would lead to a restest of the 21-EMA in the coming sessions.

With that being said, a break of daily support opens risk to the 0.7380s: