NZD/USD Price Analysis: Traders await RBA volatility to decipher the code in the market structure

- NZD/USD traders await key events to take place this week.

- The technical outlook is bullish while buyers move in to correct the dominant bearish trend.

It is quite out there in terms of volatility in Asia due to the holidays in the region. However, on a bigger scale, NZD/USD is poised for higher levels in its correction of the daily bearish trend as follows:

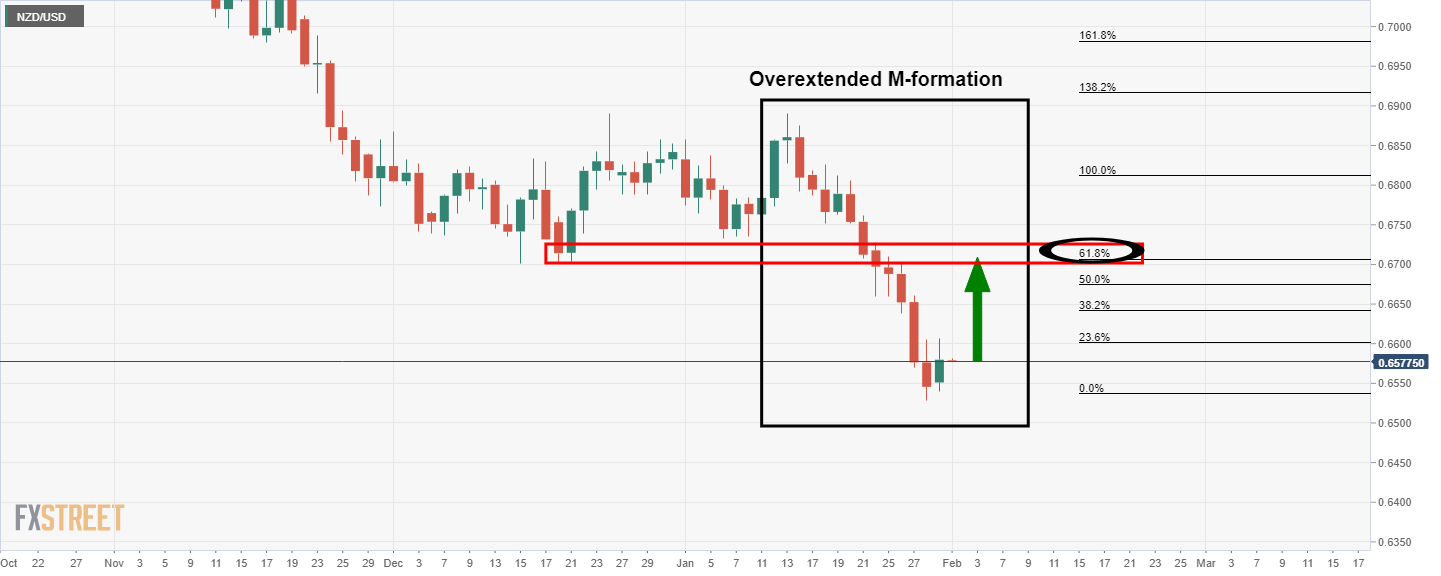

NZD/USD daily chart

The M-formation is overextended, but it is a reversion pattern nevertheless and the price would be expected to correct towards the 61.8% Fibonacci retracement level over the course of the comings days.

However, given the number of critical events this week, including the Reserve Bank of Australia at the top of the hour, traders would be prudent to allow these to play out (the cause) in order to decipher the code within the market structures subsequent of the price action (the effect).

The RBA could be the catalyst, on a hawkish outcome, to send the kiwi on the coattails of a rally in the Aussie up to test the 38.2% Fibo near 0.6640 for the day ahead. From a 4-hour basis, the structure is ripe for a run to test the resistance on the way there: