AUD/NZD Price Analysis: Bulls ad bears battle it out at critical daily resistance

- AUD/NZD is in the hands of the central banks.

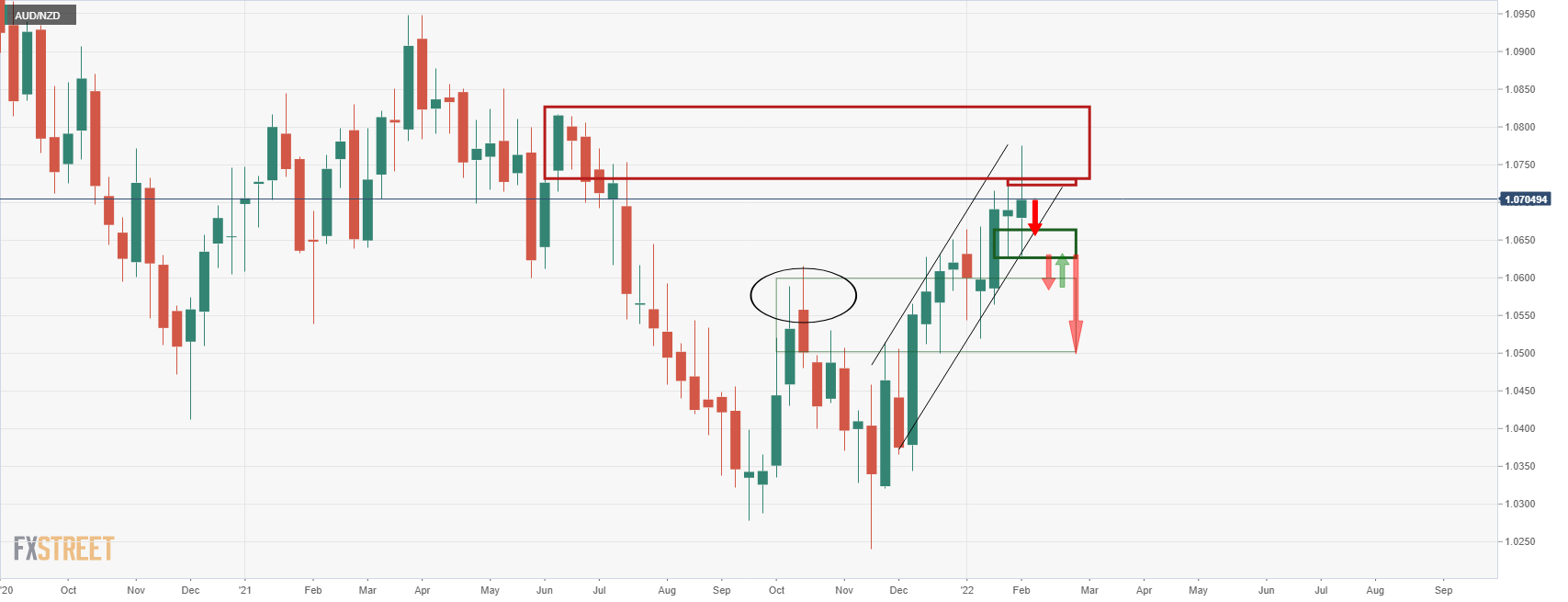

- Bulls need a break of the Daily M formation while bears seek a break of trendline support.

The market has been very long of the Reserve Bank of New Zealand hawkish sentiment that the Reserve Bank of Australia tightening expectations is ow getting more airtime and will enable the Aussie to remain bid for a while longer.

However, the 50% mean reversion level and the 61.8% Fibonacci golden ratio above there could prove to be a touch ut to crack in the coming week that guards June highs on the weekly chart. The following illustrates the downside potential on failures of a break of the ascending channel resistance.

AUD/NZD daily chart

The bears are likely protected below the neckline of the M-formation below 1.0720 ad will seek a break of the channel support and horizontal key area between 1.0665 and 1.0630.

Weekly chart

The June highs are a bullish target that could be seen of a break of 1.0750 coming into play in the week ahead. 1.0500 on the downside will otherwise be targeted on a break below 1.0630.