US Dollar Index alternates gains with losses around 95.60/70

- DXY looks for direction around 95.60/70 on Wednesday.

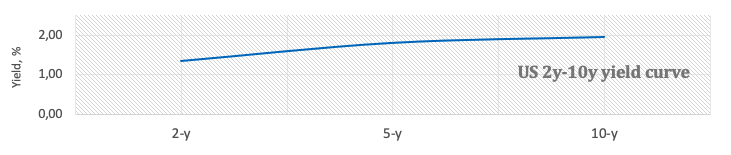

- US yields see some correction following recent peaks.

- Mortgage Applications, Wholesale Inventories, Fed’s Mester next on tap.

The greenback looks to extend the weekly recovery to the 95.60/70 band when gauged by the US Dollar Index (DXY) on Wednesday.

US Dollar Index focuses on data, yields

The index looks to add to Tuesday’s gains amidst some inconclusive price action in the 95.60/70 band so far on Wednesday, all amidst some corrective downside in US yields following recent peaks.

Indeed, US yields seem to be taking a breather early in Europe, although they keep the trade in the upper end of the recent range supported by rising speculation of a tighter lift-off by the Federal Reserve at the March FOMC event.

In the US data space, usual weekly MBA Mortgage Applications are due seconded by December’s Wholesale Inventories and the speech by Cleveland Fed L.Mester (voter, hawkish).

What to look for around USD

The dollar regained some poise in the wake of the healthy results from the Nonfarm Payrolls for the month of January. While the constructive outlook for the greenback remains well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to slow the pace of a move higher in the index in the next months. The view of a stronger dollar remains, in the meantime, underpinned by higher yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week: Wholesale Inventories, MBA Mortgage Applications (Wednesday) - CPI, Initial Claims (Thursday) - Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is gaining 0.02% at 95.64 and a break above 96.04 (55-day SMA) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.20 (200-week SMA) followed by 95.13 (weekly low Feb.4) and then 94.62 (2022 low Jan.14).