Back

5 May 2022

AUD/USD Price Analysis: Weekly resistance capping the Fed-led rally

- AUD/USD is facing a wall of weekly resistance.

- The bears are moving in and there is a focus on the hourly correction targets.

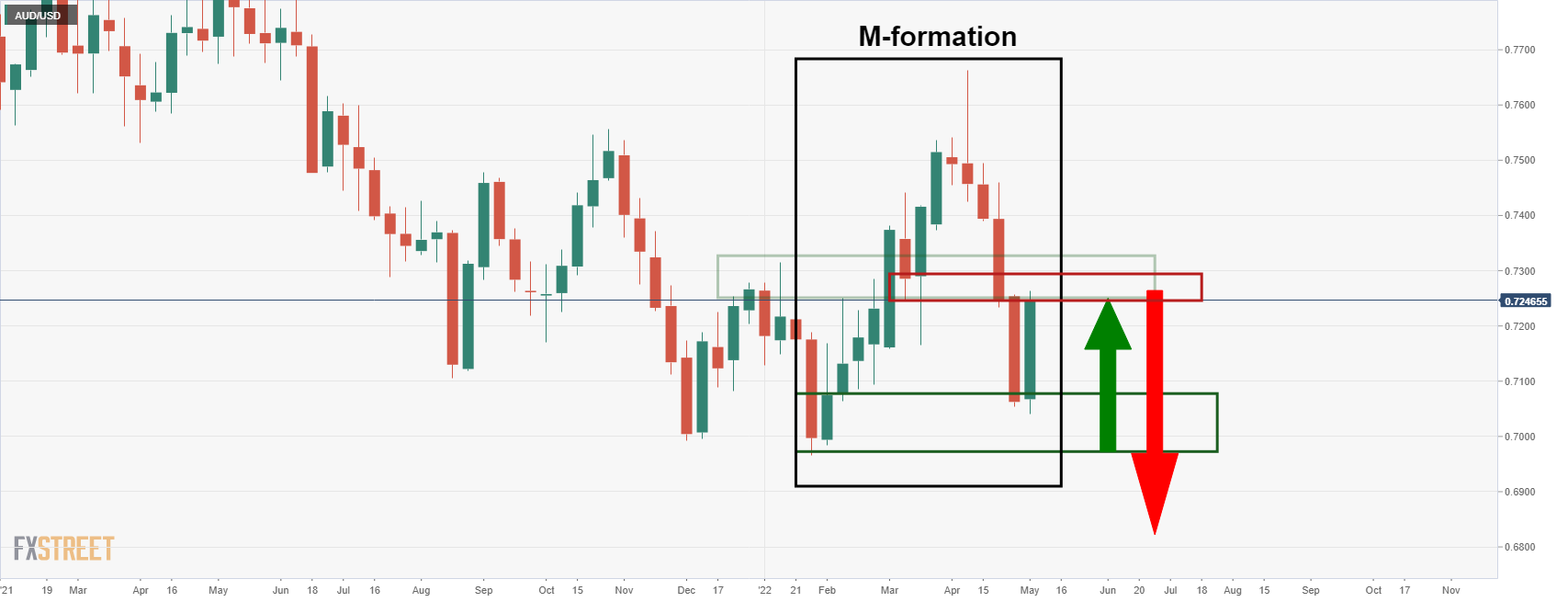

AUD/USD rallied on Wednesday following the Federal Reserve's less hawkish than an expected rate hike. The pair has shot up to test a key area of resistance on the longer-term charts as illustrated as follows:

AUD/USD weekly chart

The M-formation is a reversion pattern and it has pulled in the price to test the neckline. At the time of writing, the pair is consolidating and a correction could be on the cards as traders await the end of the week's Nonfarm Payrolls key event.

USD/JPY H1 chart

The price is starting to correct and the above structures are confluence between the Fibonacci scales and prior resistance areas on the hourly chart.